A company often has to pay small amounts for such items as postage, office supplies, fu>ndisal-purp°se or minor repairs. Although small, such payments may occur often enough to total a significant amount. Thus, it is desirable to control such payments. However, writing a check for each small payment is not practical. Instead, a special cash fund, called a petty cash fund, is used.

A petty cash fund is established by estimating the amount of payments needed from the fund during a period, such as a week or a month. A check is then written and cashed for this amount. The money obtained from cashing the check is then given to an employee, called the petty cash custodian. The petty cash custodian disburses monies from the fund as needed. For control purposes, the company may place restrictions on the maximum amount and the types of payments that can be made from the fund. Each time money is paid from petty cash, the custodian records the details on a petty cash receipts form.

The petty cash fund is normally replenished at periodic intervals, when it is depleted, or reaches a minimum amount. When a petty cash fund is replenished, the accounts debited are determined by summarizing the petty cash receipts. A check is then written for this amount, payable to Petty Cash.

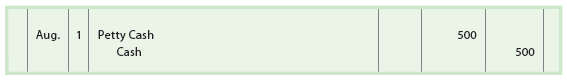

To illustrate, assume that a petty cash fund of $500 is established on August 1.

The entry to record this transaction is as follows:

The only time Petty Cash is debited is when the fund is initially established, as shown in the preceding entry, or when the fund is being increased. The only time Petty Cash is credited is when the fund is being decreased.

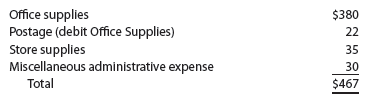

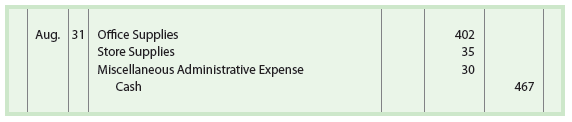

At the end of August, the petty cash receipts indicate expenditures for the following items:

The entry to replenish the petty cash fund on August 31 is as follows:

Petty Cash is not debited when the fund is replenished. Instead, the accounts affected by the petty cash disbursements are debited, as shown in the preceding entry. Replenishing the petty cash fund restores the fund to its original amount of $500.

Companies often use other cash funds for special needs, such as payroll or travel expenses. Such funds are called special-purpose funds. For example, each salesperson might be given $1,000 for travel-related expenses. Periodically, each salesperson submits an expense report, and the fund is replenished. Special-purpose funds are established and controlled in a manner similar to that of the petty cash fund.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Respect to post author, some excellent selective information.

Enjoyed examining this, very good stuff, thankyou.