For startup companies or companies in financial distress, cash is critical for survival. In their first few years, startup companies often report losses and negative net cash flows from operations. Moreover, companies in financial distress can also report losses and negative cash flows from operations. In such cases, the ratio of cash to monthly cash expenses is useful for assessing how long a company can continue to operate without:

- Additional financing, or

- Generating positive cash flows from operations

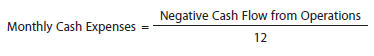

The ratio of cash to monthly cash expenses is computed as follows:

![]()

The cash, including any cash equivalents, is taken from the balance sheet as of year-end. The monthly cash expenses, sometimes called cash burn, are estimated from the operating activities section of the statement of cash flows as follows:

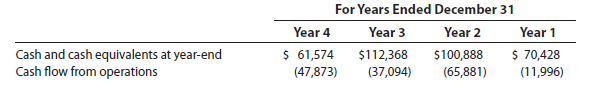

To illustrate, Evergreen Solar, Inc., manufactures solar products including solar panels that convert sunlight into electricity. The following data (in thousands) were taken from recent financial statements of Evergreen Solar:

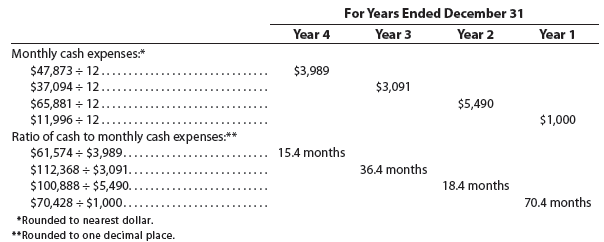

Based on the preceding data, the monthly cash expenses and ratio of cash to monthly cash expenses are computed below.

The preceding computations indicate that Evergreen Solar had 70.4 months of cash available as of December 31, Year 1. During Year 1, Evergreen raised additional cash of approximately $175 million by issuing stock.

During Year 2, Evergreen’s monthly cash expenses (cash burn) increased to $5,490 from $1,000 in Year 1. Evergreen also raised additional cash of approximately $490 million while investing approximately $350 million in plant and equipment. The result is that as of December 31, Year 2, Evergreen had 18.4 months of cash with which to continue to operate.

During Year 3, Evergreen decreased its monthly cash expenses from $5,490 in Year 2 to $3,091. In addition, Evergreen raised additional cash of $105 million by issuing stock and obtaining a loan. As a result, at the end of Year 3 Evergreen had 36.4 months of cash with which to continue to operate.

During Year 4, Evergreen’s monthly cash expenses increased from $3,091 to $3,989. As a result, Evergreen had 15.4 months of cash with which to continue to operate. Unless Evergreen can generate positive cash flows from operations, it will have to continue to raise cash from borrowing or issuing stock. In the long term, however, Evergreen cannot survive unless it generates positive cash flows from operations.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Excellent site. Lots of helpful info here. I am sending it to several buddies ans also sharing in delicious. And obviously, thank you in your sweat!