Sharp exchange rate movements can make a large dent in corporate profits. To illustrate how companies cope with this problem, we look at a typical company in the United States, Outland Steel, and walk through its foreign exchange operations.

EXAMPLE 27.1 ● Outland Steel

Outland Steel has a small but profitable export business. Contracts involve substantial delays in payment, but since the company has a policy of always invoicing in dollars, it is fully protected against changes in exchange rates. Recently, the export department has become unhappy with this practice and believes that it is causing the company to lose valuable export orders to firms that are willing to quote in the customer’s own currency.

You sympathize with these arguments, but you are worried about how the firm should price long-term export contracts when payment is to be made in foreign currency. If the value of that currency declines before payment is made, the company may suffer a large loss. You want to take the currency risk into account, but you also want to give the sales force as much freedom of action as possible.

Notice that Outland can insure against its currency risk by selling the foreign currency forward. This means that it can separate the problem of negotiating sales contracts from that of managing the company’s foreign exchange exposure. The sales force can allow for currency risk by pricing on the basis of the forward exchange rate. And you, as financial manager, can decide whether the company ought to hedge.

What is the cost of hedging? You sometimes hear managers say that it is equal to the difference between the forward rate and today’s spot rate. That is wrong. If Outland does not hedge, it will receive the spot rate at the time that the customer pays for the steel. Therefore, the cost of insurance is the difference between the forward rate and the expected spot rate when payment is received.

Insure or speculate? We generally vote for insurance. First, it makes life simpler for the firm and allows it to concentrate on its main business. Second, it does not cost much. (In fact, the cost is zero on average if the forward rate equals the expected spot rate, as the expectations theory of forward rates implies.) Third, the foreign currency market seems reasonably efficient, at least for the major currencies. Speculation should be a zero-NPV game, unless financial managers have information that is not available to the pros who make the market.

Is there any other way that Outland can protect itself against exchange loss? Of course. It can borrow foreign currency against its foreign receivables, sell the currency spot, and invest the proceeds in the United States. Interest rate parity theory tells us that in free markets the difference between selling forward and selling spot should be equal to the difference between the interest that you have to pay overseas and the interest that you can earn at home.

Our discussion of Outland’s export business illustrates four practical implications of our simple theories about forward exchange rates. First, you can use forward rates to adjust for exchange risk in contract pricing. Second, the expectations theory suggests that protection against exchange risk is usually worth having. Third, interest rate parity theory reminds us that you can hedge either by selling forward or by borrowing foreign currency and selling spot. Fourth, the cost of forward cover is not the difference between the forward rate and today’s spot rate; it is the difference between the forward rate and the expected spot rate when the forward contract matures.

Perhaps we should add a fifth implication. You don’t make money simply by buying currencies that go up in value and selling those that go down. For example, suppose that you buy Narnian leos and sell them after a year for 2% more than you paid for them. Should you give yourself a pat on the back? That depends on the interest that you have earned on your leos. If the interest rate on leos is 2 percentage points less than the interest rate on dollars, the profit on the currency is exactly canceled out by the reduction in interest income. Thus you make money from currency speculation only if you can predict whether the exchange rate will change by more or less than the interest rate differential. In other words, you must be able to predict whether the exchange rate will change by more or less than the forward premium or discount.

Transaction Exposure and Economic Exposure

The exchange risk from Outland Steel’s export business is due to delays in foreign currency payments and is therefore referred to as transaction exposure. Transaction exposure can be easily identified and hedged. Consider, for example, its exports to Europe. Since a 1% fall in the value of the euro results in a 1% fall in Outland’s dollar receipts, for every euro that Outland is owed by its customers, it needs to sell forward one euro.16

However, Outland may still be affected by currency fluctuations even if its customers do not owe it a cent. For example, Outland may be in competition with Swedish steel producers. If the value of the Swedish krona falls, Outland will need to cut its prices in order to compete.17 Outland can protect itself against such an eventuality by selling the krona forward. In this case the loss on Outland’s steel business will be offset by the profit on its forward sale.

Notice that Outland’s exposure to the krona is not limited to specific transactions that have already been entered into. Financial managers often refer to this broader type of exposure as economic exposure.1 Economic exposure is less easy to measure than transaction exposure. For example, it is clear that the value of Outland Steel is positively related to the value of the krona, so to hedge its position it needs to sell kronor forward. But, in practice, it may be hard to say exactly how many kronor Outland needs to sell.

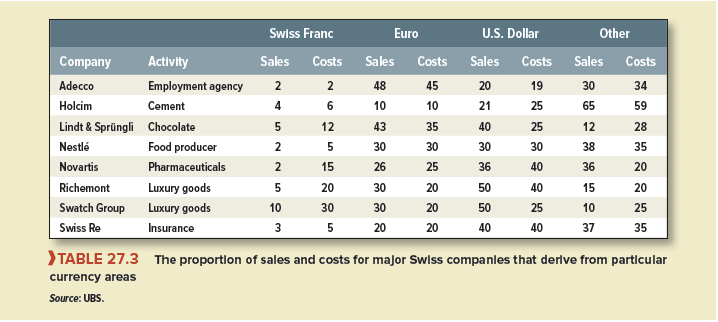

Large Swiss companies, such as Nestle or the Swatch Group, sell their products around the world. Therefore, like Outland Steel, they need to manage their economic exposure. One solution is to undertake operational hedging by balancing production closely with sales. Look, for example, at Table 27.3, which summarizes the overseas sales and costs for a sample of well-known Swiss companies. Notice that in the case of Nestle and Swiss Re, sales and costs are almost perfectly matched. These companies are, therefore, relatively immune to fluctuations in the exchange rate. By contrast, in the case of Swatch and Richemont, a substantial proportion of production costs arise in Switzerland, and therefore both companies are exposed to an appreciation of the Swiss franc.

In addition to operational hedging, companies can also control exchange rate risk by using financial hedges. They do this by borrowing in foreign currencies, selling currency forward, or using foreign currency derivatives such as swaps and options. For example, in 2014 Swatch used forwards primarily to reduce its exposure to the euro and dollar. At the end of the year, these forward contracts totaled nearly 1.5 billion Swiss francs.

Some really howling work on behalf of the owner of this site, dead outstanding articles.

Hi, Neat post. There’s a problem with your site in internet explorer, would check this… IE still is the market leader and a good portion of people will miss your excellent writing due to this problem.