We started this chapter by noting that financial plans force managers to be consistent in their goals for growth, investment, and financing. Before leaving the topic of financial planning, we should look at some general relationships between a firm’s growth objectives and its financing needs.

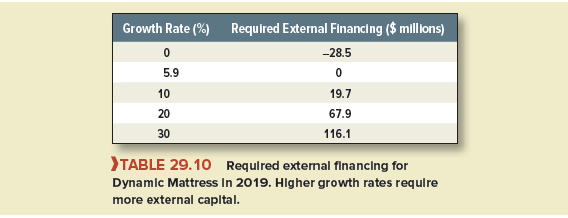

We saw in Table 29.9 that with a 20% growth rate, the firm needs to raise $67.9 million of new capital in 2019. The faster the planned growth rate the greater the need for external financing. Table 29.10 shows how required external financing responds to a changing growth rate. Notice that at a 5.9% growth rate required external financing is zero. At higher growth rates, the firm requires additional capital. At lower growth rates, reinvested earnings exceed the addition to assets and there is a surplus of funds from internal sources; this shows up as negative required external financing.

We can generalize the relationship between a firm’s growth objectives and its financing needs. If net assets are proportional to sales, then the additional assets required to support any growth in sales is

Additional net assets required = growth rate X initial net assets (29.1)

and

Required external financing = (growth rate X initial net assets) – reinvested earnings (29.2)

The maximum growth rate that a firm can achieve without raising external funds is called the internal growth rate. If we set external financing to zero in Equation 29.2, then we can solve for the internal growth rate

![]()

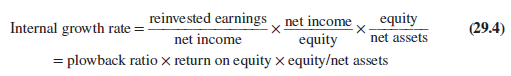

We can gain more insight into what determines this growth rate by multiplying the top and bottom of the expression for internal growth rate by net income and equity as follows:

A firm can achieve a higher growth rate without raising external capital if (1) it plows back a high proportion of its earnings, (2) it has a high return on equity (ROE), and (3) it has a low debt-to-asset ratio.[1]

Instead of focusing on how rapidly the company can grow without any external financing, Dynamic Mattress’s financial manager may be interested in the growth rate that can be sustained without additional equity issues. Of course, if the firm is able to raise enough debt, virtually any growth rate can be financed. It makes more sense to assume that the firm has settled on an optimal capital structure that it will maintain. Thus, the firm issues only enough debt to keep the debt-equity ratio constant. The sustainable growth rate is the highest growth rate the firm can maintain without increasing its financial leverage. It turns out that the sustainable growth rate depends only on the plowback rate and the return on equity:

Sustainable growth rate = plowback ratio X return on equity (29.5)

For Dynamic Mattress,

Sustainable growth rate = .40 X .1815 = .0726, or 7.26%

We first encountered this formula in Chapter 4, where we used it to value common stocks.

These simple formulas remind us that firms may grow rapidly in the short term by relying on debt finance, but such growth can rarely be maintained without incurring excessive debt levels.

I was looking through some of your posts on this site and I believe this website is very informative ! Continue putting up.

I was examining some of your articles on this internet site and I conceive this internet site is very instructive! Retain posting.