Does the prisoners’ dilemma doom oligopolistic firms to aggressive competition and low profits? Not necessarily. Although our imaginary prisoners have only one opportunity to confess, most firms set output and price over and over again, continually observing their competitors’ behavior and adjusting their own accordingly. This allows firms to develop reputations from which trust can arise. As a result, oligopolistic coordination and cooperation can sometimes prevail.

Take, for example, an industry made up of three or four firms that have coexisted for a long time. Over the years, the managers of those firms might grow tired of losing money because of price wars, and an implicit understand- ing might arise by which all the firms maintain high prices and no firm tries to take market share from its competitors. Although each firm might be tempted to undercut its competitors, its managers know that the resulting gains will be short lived: Competitors will retaliate, and the result will be renewed warfare and lower profits over the long run.

This resolution of the prisoners’ dilemma occurs in some industries, but not in others. Sometimes managers are not content with the moderately high profits resulting from implicit collusion and prefer to compete aggressively in order to increase market share. Sometimes implicit understandings are difficult to reach. For example, firms with different costs and different assessments of market demand might disagree about the “correct” collusive price. Firm A might think the “correct” price is $10, while Firm B thinks it is $9. When it sets a $9 price, Firm A might view this as an attempt to undercut and retaliate by lowering its price to $8. The result is a price war.

In many industries, therefore, implicit collusion is short lived. There is often a fundamental layer of mistrust, so warfare erupts as soon as one firm is perceived by its competitors to be “rocking the boat” by changing its price or increasing advertising.

1. Price Rigidity

Because implicit collusion tends to be fragile, oligopolistic firms often have a strong desire for price stability. This is why price rigidity can be a characteristic of oligopolistic industries. Even if costs or demand change, firms are reluctant to change price. If costs fall or market demand declines, they fear that lower prices might send the wrong message to their competitors and set off a price war. And if costs or demand rises, they are reluctant to raise prices because they are afraid that their competitors may not raise theirs.

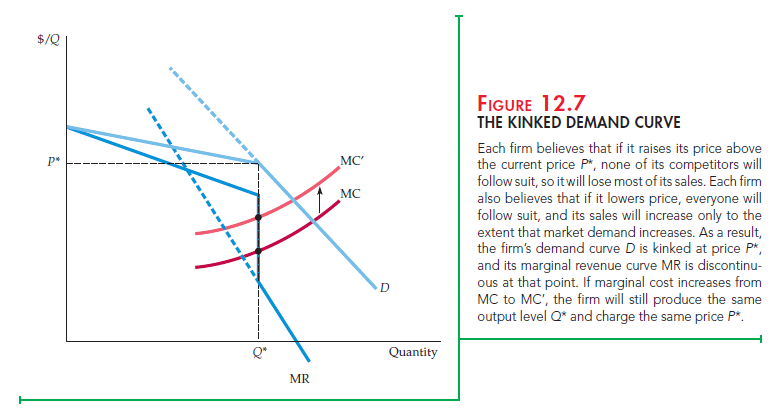

Price rigidity is the basis of the kinked demand curve model of oligopoly. According to this model, each firm faces a demand curve kinked at the currently prevailing price P*. (See Figure 12.7.) At prices above P*, the demand curve is very elastic. The reason is that the firm believes that if it raises its price above P*, other firms will not follow suit, and it will therefore lose sales and much of its market share. On the other hand, the firm believes that if it lowers its price below P*, other firms will follow suit because they will not want to lose their shares of the market. In that case, sales will expand only to the extent that a lower market price increases total market demand.

Because the firm’s demand curve is kinked, its marginal revenue curve is discontinuous. (The bottom part of the marginal revenue curve corresponds to the less elastic part of the demand curve, as shown by the solid portions of each curve.) As a result, the firm’s costs can change without resulting in a change in price. As shown in Figure 12.7, marginal cost could increase but still equal marginal revenue at the same output level, so that price stays the same.

Although the kinked demand curve model is attractively simple, it does not really explain oligopolistic pricing. It says nothing about how firms arrived at price P* in the first place, and why they didn’t arrive at some different price. It is useful mainly as a description of price rigidity rather than as an explanation of it. The explanation for price rigidity comes from the prisoners’ dilemma and from firms’ desires to avoid mutually destructive price competition.

2. Price Signaling and Price Leadership

A big impediment to implicitly collusive pricing is the fact that it is difficult for firms to agree (without talking to each other) on what the price should be. Coordination is particularly difficult when cost and demand conditions—and thus the “correct” price—are changing. Price signaling is a form of implicit collusion that sometimes gets around this problem. For example, a firm might announce that it has raised its price (perhaps through a press release) and hope that its competitors will take this announcement as a signal that they should also raise prices. If competitors follow suit, all of the firms will earn higher profits.

Sometimes a pattern is established whereby one firm regularly announces price changes and other firms in the industry follow suit. This pattern is called price leadership: One firm is implicitly recognized as the “leader,” while the other firms, the “price followers,” match its prices. This behavior solves the problem of coordinating price: Everyone charges what the leader is charging.

Suppose, for example, that three oligopolistic firms are currently charging $10 for their product. (If they all know the market demand curve, this might be the Nash equilibrium price.) Suppose that by colluding, they could all set a price of $20 and greatly increase their profits. Meeting and agreeing to set a price of $20 is illegal. But suppose instead that Firm A raises its price to $15, and announces to the business press that it is doing so because higher prices are needed to restore economic vitality to the industry. Firms B and C might view this as a clear message—namely, that Firm A is seeking their cooperation in raising prices. They might then raise their own prices to $15. Firm A might then increase price further—say, to $18—and Firms B and C might raise their prices as well. Whether or not the profit-maximizing price of $20 is reached (or surpassed), a pattern of coordination has been established that, from the firm’s point of view, may be nearly as effective as meeting and formally agreeing on a price.[1]

This example of signaling and price leadership is extreme and might lead to an antitrust lawsuit. But in some industries, a large firm might naturally emerge as a leader, with the other firms deciding that they are best off just matching the leader’s prices, rather than trying to undercut the leader or each other. An example is the U.S. automobile industry, where General Motors has traditionally been the price leader.

Price leadership can also serve as a way for oligopolistic firms to deal with the reluctance to change prices, a reluctance that arises out of the fear of being undercut or “rocking the boat.” As cost and demand conditions change, firms may find it increasingly necessary to change prices that have remained rigid for some time. In that case, they might look to a price leader to signal when and by how much price should change. Sometimes a large firm will naturally act as leader; sometimes different firms will act as leader from time to time. The example that follows illustrates this.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

I was examining some of your posts on this site and I believe this web site is real instructive! Keep putting up.

Thanks a lot for sharing this with all folks you actually know what you are talking about! Bookmarked. Kindly also consult with my site =). We can have a link change contract between us!