Before proceeding, we must be clear about how to measure capital and other factor inputs that firms purchase. Capital is measured as a stock, i.e., as a quantity of plant and equipment that the firm owns. For example, if a firm owns an electric motor factory worth $10 million, we say that it has a capital stock worth $10 million. Inputs of labor and raw materials, on the other hand, are measured as flows. The output of the firm is also a flow. For example, this same firm might use 20,000 worker-hours of labor and 20,000 pounds of copper per month to produce 8000 electric motors per month. (The choice of monthly units is arbitrary; we could just as well have expressed these quantities in weekly or annual terms—for example, 240,000 worker- hours of labor per year, 240,000 pounds of copper per year, and 96,000 motors per year.)

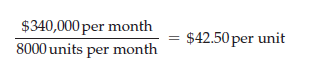

Let’s look at this producer of electric motors in more detail. Both variable cost and the rate of output are flows. Suppose the wage rate is $15 per hour and the price of copper is $2.00 per pound. Thus the variable cost is (20,000)($15) + (20,000)($2.00) = $340,000 per month. Average variable cost, on the other hand, is a cost per unit:

Suppose the firm sells its motors for $52.50 each. Then its average profit is $52.50 – $42.50 = $10.00 per unit, and its total profit is $80,000 per month. (Note that total profit is also a flow.) To make and sell these motors, however, the firm needs capital—namely, the factory that it built for $10 million.

Thus the firm’s $10 million capital stock allows it to earn a flow of profit of $80,000 per month.

Was the $10 million investment in this factory a sound decision? To answer this question, we must translate the $80,000 per month profit flow into a number that we can compare with the factory’s $10 million cost. Suppose the factory is expected to last for 20 years. In that case the problem, simply put, is: What is the value today of $80,000 per month for the next 20 years? If that value is greater than $10 million, the investment was a good one.

A profit of $80,000 per month for 20 years comes to ($80,000)(20)(12) = $19.2 million. That would make the factory seem like an excellent investment. But is $80,000 five years—or 20 years—from now worth $80,000 today? No, because money today can be invested—in a bank account, a bond, or other interest-bearing

assets—to yield more money in the future. As a result, $19.2 million received over the next 20 years is worth less than $19.2 million today.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

19 Apr 2021

26 Apr 2021

16 Apr 2021

20 Apr 2021

19 Apr 2021

16 Apr 2021