We have seen that asymmetric information can sometimes lead to a lemons prob- lem: Because sellers know more about the quality of a good than buyers do, buy- ers may assume that quality is low, causing price to fall and only low-quality goods to be sold. We also saw how government intervention (in the market for health insurance, for example) or the development of a reputation (in service industries, for example) can alleviate this problem. Now we will examine another important mechanism through which sellers and buyers deal with the problem of asymmetric information: market signaling. The concept of market signaling was first developed by Michael Spence, who showed that in some markets, sell- ers send buyers signals that convey information about a product’s quality.

To see how market signaling works, let s look at a labor market, which is a good example of a market with asymmetric information. Suppose a firm is thinking about hiring some new people. The new workers (the “sellers” of labor) know much more about the quality of the labor they can provide than does the firm (the buyer of labor). For example, they know how hard they tend to work, how responsible they are, what their skills are, and so forth. The firm will learn these things only after workers have been hired and have been working for some time.

Why don’t firms simply hire workers, see how well they work, and then fire those with low productivity? Because this policy is often very costly. In many countries, and in many firms in the United States, it is difficult to fire someone who has been working more than a few months. (The firm may have to show just cause or provide severance pay.) Moreover, in many jobs, workers do not become fully productive for at least six months. Before that time, considerable on-the-job training may be required, for which the firm must invest substantial resources. Thus the firm might not learn how good workers are for six months to a year. Clearly, firms would be much better off if they knew how productive potential employees were before they hired them.

What characteristics can a firm examine to obtain information about people’s productivity before it hires them? Can potential employees convey information about their productivity? Dressing well for the job interview might convey some information, but even unproductive people can dress well. Dressing well is thus a weak signal—it doesn’t do much to distinguish high-productivity from low- productivity people. To be strong, a signal must be easier for high-productivity people to give than for low-productivity people to give, so that high-productivity people are more likely to give it.

For example, education is a strong signal in labor markets. A person’s educational level can be measured by several things—the number of years of schooling, degrees obtained, the reputation of the university or college that granted the degrees, the person’s grade-point average, and so on. Of course, education can directly and indirectly improve a person’s productivity by providing information, skills, and general knowledge that are helpful in work. But even if education did not improve productivity, it would still be a useful signal of productivity because more productive people find it easier to attain high levels of education. Not surprisingly, productive people tend to be more intelligent, more motivated, more disciplined, and more energetic and hard-working—characteristics that are also helpful in school.

More productive people are therefore more likely to attain high levels of education in order to signal their productivity to firms and thereby obtain better-paying jobs. Thus, firms are correct in considering education a signal of productivity.

1. A Simple Model of Job Market Signaling

To understand how signaling works, we will discuss a simple model. Let’s assume that there are only low-productivity workers (Group I), whose average and marginal product is 1, and high-productivity workers (Group II), whose average and marginal product is 2. Workers will be employed by competitive firms whose products sell for $10,000, and who expect an average of 10 years’ work from each employee. We also assume that half the workers in the population are in Group I and the other half in Group II, so that the average productivity of all workers is 1.5. Note that the revenue expected to be generated from Group I workers is $100,000 ($10,000/year X 10 years) and from Group II workers is $200,000 ($20,000/year X 10 years).

If firms could identify people by their productivity, they would offer them a wage equal to their marginal revenue product. Group I people would be paid $10,000 per year, Group II people $20,000. On the other hand, if firms could not identify productivity before they hired people, they would pay all workers an annual wage equal to the average productivity—$15,000. Group I people would then earn more ($15,000 instead of $10,000), at the expense of Group II people (who would earn $15,000 instead of $20,000).

Now let’s consider what can happen with signaling via education. Suppose all the attributes of an education (degrees earned, grade-point average, etc.) can be summarized by a single index y that represents years of higher education. All education involves a cost, and the higher the educational level y, the higher the cost. This cost includes tuition and books, the opportunity cost of foregone wages, and the psychic cost of having to work hard to obtain high grades. What is important is that the cost of education is greater for the low-productivity group than for the high-productivity group. We might expect this to be the case for two reasons. First, low-productivity workers may simply be less studious. Second, low-productivity workers may progress more slowly through degree programs. In particular, suppose that for Group I people, the cost of attaining educational level y is given by

Q(y) = $40,000y

and the cost for Group II people is

Cn(y) = $20,000y

Now suppose (to keep things simple and to dramatize the importance of signaling) that education does nothing to increase one’s productivity; its only value is as a signal. Let’s see if we can find a market equilibrium in which different people obtain different levels of education, and in which firms look at education as a signal of productivity.

EQUILIBRIUM Consider the following possible equilibrium. Suppose firms use this decision rule: Anyone with an education level of y* or more is a Group II person and is offered a wage of $20,000, while anyone with an education level below y* is a Group I person and is offered a wage of $10,000. The particular level y* that the firms choose is arbitrary, but for this decision rule to be part of an equilibrium, firms must have identified people correctly. Otherwise, the firms will want to change the rule. Will it work?

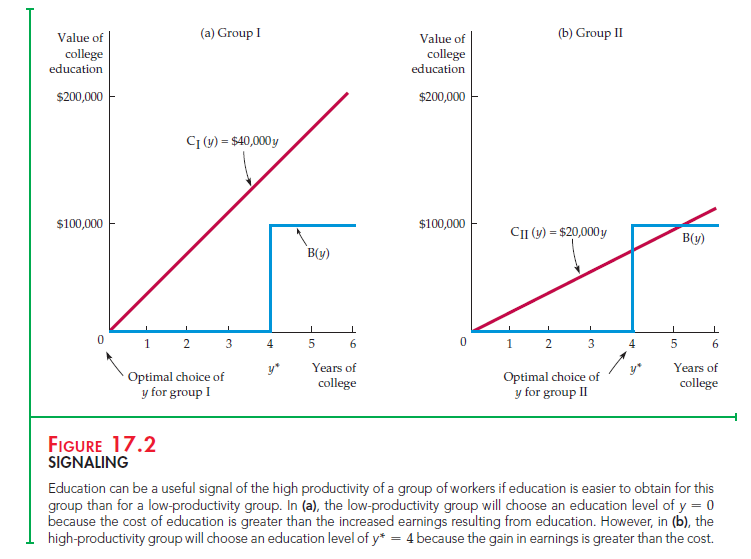

To answer this question, we must determine how much education the people in each group will obtain, given that firms are using this decision rule. To do this, remember that education allows one to get a better-paying job. The benefit of education B(y) is the increase in the wage associated with each level of education, as shown in Figure 17.2. Observe that B(y) is 0 initially, which represents the $100,000 base 10-year earnings that are earned without any college education. For an education level less than y*, B(y) remains 0, because 10-year earnings remain at the $100,000 base level. But when the education level reaches y* or greater, 10-year earnings increase to $200,000, increasing B(y) to $100,000.

How much education should a person obtain? Clearly the choice is between no education (i.e., y = 0) and an education level of y*. Why? Any level of education less than y* results in the same base earnings of $100,000. Thus there is no benefit from obtaining an education at a level above 0 but below y*. Similarly, there is no benefit from obtaining an educational level above y* because y* is sufficient to allow one to enjoy the higher total earnings of $200,000.

COST-BENEFIT COMPARISON In deciding how much education to obtain, people compare the benefit of education with the cost. People in each group make the following cost-benefit calculation: Obtain the education level y* if the benefit (i.e., the increase in earnings) is at least as large as the cost of this education. For both groups, the benefit (the increase in earnings) is $100,000. The costs, however, differ. For Group I, the cost is $40,000y, but for Group II it is only $20,000y.

Therefore, Group I will obtain no education as long as

$100,000 < $40,000y* or y* > 2.5

and Group II will obtain an education level y* as long as

$100,000 > $20,000y* or y* < 5

These results give us an equilibrium as long as y* is between 2.5 and 5. Suppose, for example, that y* is 4.0, as in Figure 17.2. In that case, people in Group I will find that education does not pay and will not obtain any, whereas people in Group II will find that education does pay and will obtain the level y = 4.0. Now, when a firm interviews job candidates who have no college education, it correctly assumes they have low productivity and offers them a wage of $10,000. Similarly, when the firm interviews people who have four years of college, it correctly assumes their productivity is high, warranting a wage of $20,000. We therefore have an equilibrium. High-productivity people will obtain a college education to signal their productivity; firms will read this signal and offer them a high wage.

This is a highly simplified model, but it illustrates a significant point: Education can be an important signal that allows firms to sort workers according to productivity. Some workers (those with high productivity) will want to obtain a college education even if that education does nothing to increase their productivity. These workers simply want to identify themselves as highly productive, so they obtain the education needed to send a signal.

In the real world, of course, education does provide useful knowledge and does increase one’s ultimate productivity. (We wouldn’t have written this book if we didn’t believe that.) But education also serves a signaling function. For example, many firms insist that a prospective manager have an MBA. One reason is that MBAs learn economics, finance, and other useful subjects. But there is a second reason: To complete an MBA program takes intelligence, discipline, and hard work, and people with those qualities tend to be very productive.

2. Guarantees and Warranties

We have stressed the role of signaling in labor markets, but it can also play an important role in many other markets in which there is asymmetric information. Consider the markets for such durable goods as televisions, stereos, cameras, and refrigerators. Many firms produce these items, but some brands are more dependable than others. If consumers could not tell which brands tend to be more dependable, the better brands could not be sold for higher prices. Firms that produce a higher-quality, more dependable product must therefore make consumers aware of this difference. But how can they do it in a convincing way? The answer is guarantees and warranties.

Guarantees and warranties effectively signal product quality because an extensive warranty is more costly for the producer of a low-quality item than for the producer of a high-quality item. The low-quality item is more likely to require servicing under the warranty, for which the producer will have to pay. In their own self-interest, therefore, producers of low-quality items will not offer extensive warranties. Thus consumers can correctly view extensive warranties as signals of high quality and will pay more for products that offer them.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

You can certainly see your expertise in the work you

write. The world hopes for more passionate writers

such as you who aren’t afraid to say how they believe.

Always follow your heart.

The post is actually beneficial and also really encouraging.

There’s certainly a great deal to learn about this subject.I like all the points you’ve made.