Flexible production means the ability to vary production inputs or outputs in response to fluctuating demand or prices. Take the case of CT (combustion-turbine) generating plants, which are designed to deliver short bursts of peak-load electrical power. CTs can’t match the thermal efficiency of coal or nuclear power plants, but CTs can be turned on or off on short notice. The coal plants and “nukes” are efficient only if operated on “base load” for long periods.

The profits from operating a CT depend on the spark spread—that is, on the difference between the price of electricity and the cost of the natural gas used as fuel. CTs are money- losers at average spark spreads, but the spreads are volatile and can spike to very high levels when demand is high and generating capacity tight. Thus, a CT delivers a series of call options that can be exercised day by day (even hour by hour) when spark spreads are sufficiently high. The call options are normally out-of-the-money (CTs typically operate only about 5% of the time), but the money made at peak prices makes investment in the CTs worthwhile.

The volatility of spark spreads depends on the correlation between the price of electricity and the price of natural gas used as fuel. If the correlation were 1.0, so that electricity and natural gas prices moved together dollar for dollar, the spark spread would barely move from its average value, and the options to operate the gas turbine would be worthless. But, in fact, the correlation is less than 1.0, so the options are valuable. In addition, some CTs are set up to give a further option because they can be run on oil as well as natural gas.

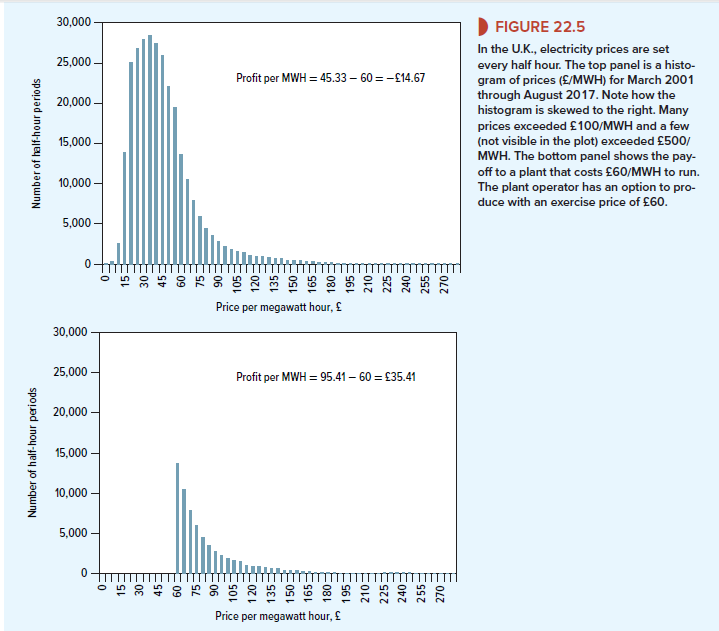

The top panel of Figure 22.5 shows a histogram of electricity prices for the U.K. between March 2001 and August 2017. Prices are set every half hour, so there are nearly 300,000 prices plotted. Prices are quoted as pounds per megawatt-hour (£/MWH). Notice how strongly the histogram is skewed to the right. Although the average price was only £45 per MWH, prices above £100/MWH crop up regularly when electricity demand peaks. The highest price was £5,003/MWH. The occasional high prices are hardly visible in the top panel of Figure 22.5. The bottom panel plots only the prices above £60/MWH.

Suppose you have a CT generating plant in the U.K. that is profitable only at prices above £60/MWH. If the plant was in continuous operation, the profit per MWH would be negative at £45.33 – 60 = -£14.67. But it would be better to leave the plant idle when prices are low and to exercise your option to operate only when prices are above £60. Although the plant would have been idle for nearly three-quarters of the time, it would have reaped an average profit of 95.41 – 60 = £35.41 per MWH when it was producing. The possible payoffs are plotted in the bottom panel of Figure 22.5. The payoff line exactly matches the payoff diagrams for call options with an exercise price of £60. The only difference is that your plant has about 17,500 options every year, one for each half hour in the year.

The payoff line in Figure 22.5 assumes that the plant’s operating cost is constant at £60. This is accurate only if the cost of natural gas is constant. Otherwise, the payoff to the option to operate depends on the spark spread. Often, the cost of gas is locked in by contract between the generator and the gas supplier. But if the cost of gas is sufficiently volatile, you would replot Figure 22.5 in spark spreads rather than electricity prices. You would operate when the spark spread is positive.

In this example, the output is the same (electricity); option value comes from the ability to vary the level of output. In other cases, option value comes from the flexibility to switch from product to product using the same production facilities. For example, textile firms have invested heavily in computer-controlled knitting machines, which allow production to shift from product to product, or from design to design, as demand and fashion dictate.

Flexibility in procurement can also have option value. For example, a computer manufacturer planning next year’s production must also plan to buy components, such as disk drives and microprocessors, in large quantities. Should it strike a deal today with the component manufacturer? This locks in the quantity, price, and delivery dates. But it also gives up flexibility—for example, the ability to switch suppliers next year or buy at a “spot” price if next year’s prices are lower.

For example, Hewlett-Packard used to customize printers for foreign markets and then ship the finished printers. If it did not correctly forecast demand, it was liable to end up with too many printers designed for the German market (say) and too few for the French market. The company’s solution was to ship printers that were only partially assembled and then to

customize them once it had firm orders. The change made for higher manufacturing costs, but these costs were more than compensated by the extra flexibility. In effect, Hewlett-Packard gained a valuable option to delay the cost of configuring the printers.

1. Aircraft Purchase Options

For our final example, we turn to the problem confronting airlines that order new airplanes for future use. In this industry, lead times between an order and delivery can extend to several years. Long lead times mean that airlines that order planes today may end up not needing them. You can see why an airline might negotiate an aircraft purchase option.

In Section 10-4, we used aircraft purchase options to illustrate the option to expand. What we said there was the truth, but not the whole truth. Let’s take another look. Suppose an airline forecasts a need for a new Airbus A320 four years hence.[4] It has at least three choices.

- Commit now. It can commit now to buy the plane, in exchange for Airbus’s offer of locked-in price and delivery date.

- Acquire option. It can seek a purchase option from Airbus, allowing the airline to decide later whether to buy. A purchase option fixes the price and delivery date if the option is exercised.

- Wait and decide later. Airbus will be happy to sell another A320 at any time in the future if the airline wants to buy one. However, the airline may have to pay a higher price and wait longer for delivery, especially if the airline industry is flying high and many planes are on order.

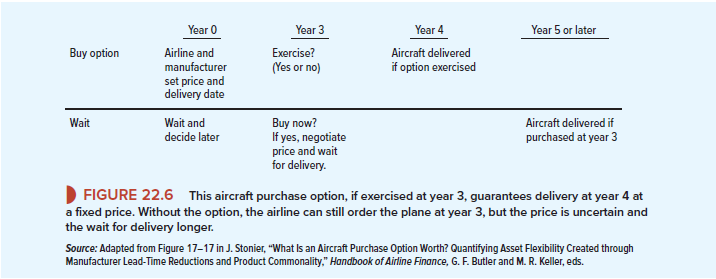

The top half of Figure 22.6 shows the terms of a typical purchase option for an Airbus A320. The option must be exercised at year 3, when final assembly of the plane will begin. The option fixes the purchase price and the delivery date in year 4. The bottom half of the figure shows the consequences of “wait and decide later.” We assume that the decision will come at year 3. If the decision is “buy,” the airline pays the year-3 price and joins the queue for delivery in year 5 or later.

The payoffs from “wait and decide later” can never be better than the payoffs from an aircraft purchase option since the airline can discard the option and negotiate afresh with Airbus if it wishes. In most cases, however, the airline will be better off in the future with the option than without it; the airline is at least guaranteed a place in the production line, and it may have locked in a favorable purchase price. But how much are these advantages worth today, compared to the wait-and-see strategy?

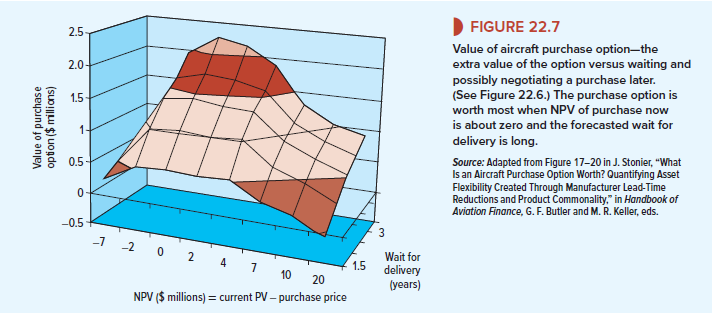

Figure 22.7 illustrates Airbus’s answers to this problem. It assumes a three-year purchase option with an exercise price equal to an A320 price of $45 million. The present value of the purchase option depends on both the NPV of purchasing an A320 at that price and on the forecasted wait for delivery if the airline does not have a purchase option but nevertheless decides to place an order in year 3. The longer the wait in year 3, the more valuable it is to have the purchase option today. (Remember that the purchase option holds a place in the A320 production line and guarantees delivery in year 4.)

If the NPV of buying an A320 today is very high (the right-hand side of Figure 22.7), future NPV will probably be high as well, and the airline will want to buy regardless of whether it has a purchase option. In this case, the value of the purchase option comes mostly from the value of guaranteed delivery in year 4.[5] If the NPV is very low, then the option has low value because the airline is unlikely to exercise it. (Low NPV today probably means low NPV in year 3.) The purchase option is worth the most, compared to the wait-and-decide-later strategy, when NPV is around zero. In this case, the airline can exercise the option, getting a good price and early delivery, if future NPV is higher than expected; alternatively, it can walk away from the option if NPV disappoints. Of course, if it walks away, it may still wish to negotiate with Airbus for delivery at a price lower than the option’s exercise price.

We have cruised by many of the technical details of Airbus’s valuation model for purchase options. But the example does illustrate how real-options models are being built and used. By the way, Airbus offers more than just plain-vanilla purchase options. Airlines can negotiate “rolling options,” which lock in price but do not guarantee a place on the production line. (Exercise of the rolling option means that the airline joins the end of the queue.) Airbus also offers a purchase option that includes the right to switch from delivery of an A320 to an A319, a somewhat smaller plane.

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.