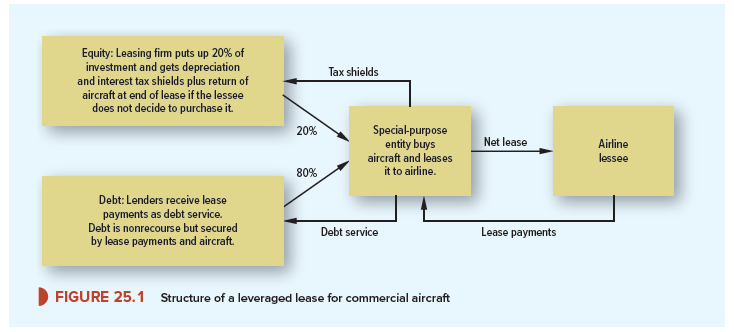

Big-ticket leases are usually leveraged leases. The structure of a leveraged lease is summarized in Figure 25.1. In this example, the leasing company (or a syndicate of several leasing companies) sets up a special-purpose entity (SPE) to buy and lease a commercial aircraft. The SPE raises up to 80% of the cost of the aircraft by borrowing, usually from insurance companies or other financial institutions. The leasing company puts up the remaining 20% as the equity investment in the lease.

Once the lease is up and running, lease payments begin, and depreciation and interest tax shields are generated. All (or almost all) of the lease payments go to debt service. The leasing company gets no cash inflows until the debt is paid off, but does get all depreciation and interest deductions, which generate tax losses that can be used to shield other income.

By the end of the lease, the debt is paid off and the tax shields exhausted. At this point, the lessee has the option to purchase the aircraft. The leasing company gets the purchase price if the lessee’s purchase option is exercised and takes back the aircraft otherwise. (In some cases, the lessee also has an early buyout option partway through the term of the lease.)

The debt in a leveraged lease is nonrecourse. The lenders have first claim on the lease payments and on the aircraft if the lessee can’t make scheduled payments but no claim on the leasing company. Thus, the lenders must depend solely on the airline lessee’s credit and on the airplane as collateral.

So the leasing company puts up only 20% of the money, gets 100% of the tax shields, but is not on the hook if the lease transaction falls apart. Does this sound like a great deal? Don’t jump to that conclusion, because the lenders will demand a higher interest rate in exchange for giving up recourse. In efficient debt markets, paying extra interest to avoid recourse should be a zero-NPV transaction—otherwise, one side of the deal would get a free ride at the expense of the other. Nevertheless, nonrecourse debt, as part of the overall structure shown in Figure 25.1, is a customary and convenient financing method.

Hi there, I log on to your new stuff daily. Your story-telling

style is witty, keep doing what you’re doing!

Hi, all is going well here and ofcourse every one

is sharing information, that’s genuinely good, keep up writing.

I pay a visit each day some websites and information sites to read posts,

but this website offers feature based posts.

Having read this I believed it was extremely enlightening.

I appreciate you finding the time and energy to put this informative article together.

I once again find myself spending a lot of time

both reading and commenting. But so what, it was still worthwhile!