L’Oreal is the world’s leading cosmetics company, with consolidated sales of Rs. 14 billion euros, with 300 subsidiaries across the globe and having presence in over 150 countries. They develop more than 3000 formulas each year, and have a worldwide team of 50,500 employees, including 3000 employees in research spread over 42 factories across the globe. L’Oreal India, spread across 300 major towns and cities, has three mother brands—L’Oreal, Garnier and Maybelline— and achieved a growth of 70 per cent over the last two years. The company manufactures products in various categories for both the mass as well as the premium segment—hair colour and care, skin cleansing and care, and make-up. L’Oreal India recorded a turnover of INR 6 billion and a growth of nearly 40 per cent in 2007.

Regulations in India in 1990 prevented L’Oreal from entering solo, and the company formed a joint venture with the MJ Group to launch the Ultra Doux range of hair care products. Encouraged by the acceptance of its brand in India, L’Oreal seized the opportunity to break the JV and formed its own subsidiary in 1994.

The company has commissioned a plant near Pune, providing proximity to the company’s head office in Mumbai. This plant manufactures hair care, hair colour and skin care products for the Indian market, besides exporting to the neighbouring countries. Consumers are likely to get benefited from the most advanced production quality standards, with manufacturing processes in the plant taking place in well-defined, isolated zones to minimize contamination. The new facility is equipped with the most modern effluent treatment plants.

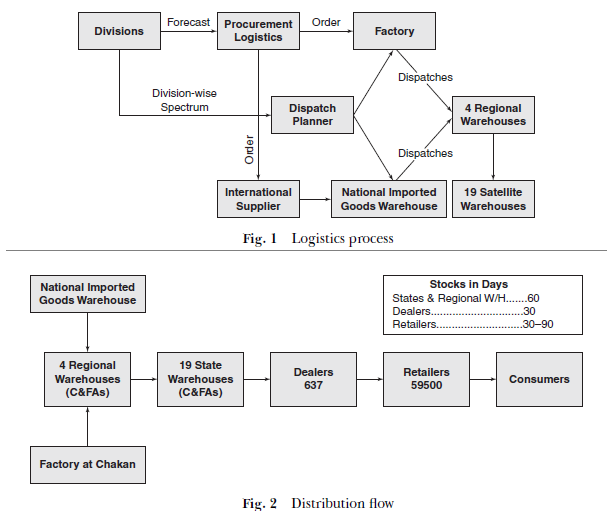

L’Oreal has an ever-expanding SKU range of over 700 in number. Eighty per cent of its SKUs (finished goods) and 76 per cent of the raw materials are imported, even for the locally manufactured products. These imports contribute to a longer lead time. The company’s logistics network consists of 23 warehouses, 637 distributors and 59,500 retailers.

The company distributes the material through 23 clearing and forwarding agents (C&FA)— one in each state—who provide warehousing, invoicing and delivery facilities. Consignment sales through C&FA are helping L’Oreal India to avoid double taxation of 4 per cent for inter-state sales, bring in flexibility of order sizes, and enhance the efficiency of transportation. Currently, the cost of transportation is less than 2 per cent of net sales. The stocks at C&FAs, dealers and retailers are for 60 days, 30 days and 30-90 days, respectively. The break-up of logistics cost at L’Oreal India is 1.5 per cent freight, 0.7 per cent warehousing and 0.3 per cent overheads totalling 2.5 per cent, which is within the FMCG industry standards. On an average, the payment receivable stands at 10 days. The SKU level is 725, consisting of 455 for consumer products, 239 for professional products and 31 for active cosmetics. At any point of time, fast moving SKUs are 200. The company has a flexible ordering system by distribution through CFA with a frequency of twice a week to once a month.

Procurement planning and scheduling for imported SKUs is based on the sales forecast (both for domestic and export markets). Order quantity is worked out by considering 75 days lead time for “A” class items and 60 days for the rest of the items and deducting the stocks in transit to 23 warehouses. For individual regional requirements the same process holds good.

The company had changed its policy of holding two months’ stock (one month at the national warehouse and another at the CFAs) because of some supply chain optimization initiatives, which resulted in the stock cover falling to just about 40 days. This was because of adopting efficient distribution practices (such as managing to distribute the right stocks at the right place and at the right time) that resulted in avoiding heavy shortages. A large increase in volumes enabled the company to renegotiate freight rates with transporters and a reduction of 11.5 per cent was achieved by the department. Another reason contributing to the overall reduction in operations cost was the increase in sales volume, which led to the increase in manufacturing batch sizes resulting in lesser production costs and better margins for 2007.

Unlike its competitors, LOreal India is not into the JIT (just-in-time) stock management system. It follows the practice of keeping one month’s inventory at the CFA level in the beginning of the month and another one month’s stock at the warehouse plus in-transit inventory resulting into increased inventory-holding cost of the company. Improper forecasting (68 per cent accuracy) is what is responsible for this lower performance compared to the competitors. Further steps towards improvising forecasts will help the company to reduce the inventory-holding costs, thereby enhancing the profit margins.

Source: Sople V.V (2013), Logistics Management, Pearson Education India; Third edition.

Some genuinely great information, Sword lily I discovered this.