Cost is the primary basis for valuing and reporting inventories in the financial state- statements. ments. However, inventory may be valued at other than cost in the following cases:

- The cost of replacing items in inventory is below the recorded cost.

- The inventory cannot be sold at normal prices due to imperfections, style changes, or other causes.

1. Valuation at Lower of Cost or Market

If the cost of replacing inventory is lower than its recorded purchase cost, the lower- of-cost-or-market (LCM) method is used to value the inventory. Market, as used in lower of cost or market, is the cost to replace the inventory. The market value is based on normal quantities that would be purchased from suppliers.

The lower-of-cost-or-market method can be applied in one of three ways. The cost, market price, and any declines could be determined for the following:

- Each item in the inventory.

- Each major class or category of inventory.

- Total inventory as a whole.

The amount of any price decline is included in the cost of merchandise sold. This, in turn, reduces gross profit and net income in the period in which the price declines occur. This matching of price declines to the period in which they occur is the primary advantage of using the lower-of-cost-or-market method.

To illustrate, assume the following data for 400 identical units of Item A in inventory on December 31, 2014:

![]()

Since Item A could be replaced at $9.50 a unit, $9.50 is used under the lower-of- cost-or-market method.

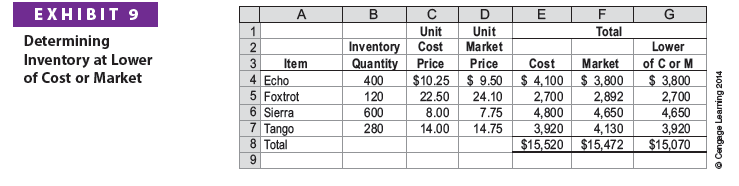

Exhibit 9 illustrates applying the lower-of-cost-or-market method to each inventory item (Echo, Foxtrot, Sierra, Tango). As applied on an item-by-item basis, the total lower- of-cost-or-market is $15,070, which is a market decline of $450 ($15,520 – $15,070). This market decline of $450 is included in the cost of merchandise sold.

In Exhibit 9, Items Echo, Foxtrot, Sierra, and Tango could be viewed as a class of inventory items. If the lower-of-cost-or-market method is applied to the class, the inventory would be valued at $15,472, which is a market decline of $48 ($15,520 – $15,472). Likewise, if Items Echo, Foxtrot, Sierra, and Tango make up the total inventory, the lower-of-cost-or-market method as applied to the total inventory would be the same amount, $15,472.

2. Valuation at Net Realizable Value

Merchandise that is out of date, spoiled, or damaged can often be sold only at a price below its original cost. Such merchandise should be valued at its net realizable value. Net realizable value is determined as follows:

Net Realizable Value = Estimated Selling Price – Direct Costs of Disposal

Direct costs of disposal include selling expenses such as special advertising or sales commissions. To illustrate, assume the following data about an item of damaged merchandise:

The merchandise should be valued at its net realizable value of $650 as shown below.

Net Realizable Value = $800 – $150 = $650

3. Merchandise Inventory on the Balance Sheet

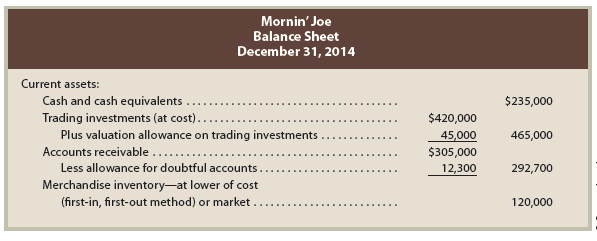

Merchandise inventory is usually reported in the Current Assets section of the balance sheet. In addition to this amount, the following are reported:

- The method of determining the cost of the inventory (FIFO, LIFO, or weighted average)

- The method of valuing the inventory (cost or the lower of cost or market)

The financial statement reporting for the topics covered in Chapters 6-13 are illustrated using excerpts from the financial statements of Mornin’ Joe. Mornin’ Joe is a fictitious company that offers drip and espresso coffee in a coffeehouse setting. The complete financial statements of Mornin’ Joe are illustrated at the end of Chapter 13 (pages 629-639). The balance sheet presentation for merchandise inventory for Mornin’ Joe is as follows:

It is not unusual for a large business to use different costing methods for segments of its inventories. Also, a business may change its inventory costing method. In such cases, the effect of the change and the reason for the change are disclosed in the financial statements.

4. Effect of Inventory Errors on the Financial Statements

Any errors in merchandise inventory will affect the balance sheet and income statement. Some reasons that inventory errors may occur include the following:

- Physical inventory on hand was miscounted.

- Costs were incorrectly assigned to inventory. For example, the FIFO, LIFO, or weighted average cost method was incorrectly applied.

- Inventory in transit was incorrectly included or excluded from inventory.

- Consigned inventory was incorrectly included or excluded from inventory.

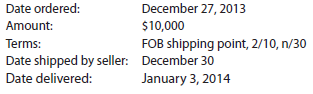

Inventory errors often arise from merchandise that is in transit at year-end. As discussed in Chapter 5, shipping terms determine when the title to merchandise passes. When goods are purchased or sold FOB shipping point, title passes to the buyer when the goods are shipped. When the terms are FOB destination, title passes to the buyer when the goods are received.

To illustrate, assume that SysExpress ordered the following merchandise from American Products:

When SysExpress counts its physical inventory on December 31, 2013, the merchandise is still in transit. In such cases, it would be easy for SysExpress to not include the $10,000 of merchandise in its December 31 physical inventory. However, since the merchandise was purchased FOB shipping point, SysExpress owns the merchandise. Thus, it should be included in the December 31 inventory, even though it is not on hand. Likewise, any merchandise sold by SysExpress FOB destination is still SysExpress’s inventory, even if it is in transit to the buyer on December 31.

Inventory errors often arise from consigned inventory. Manufacturers sometimes ship merchandise to retailers who act as the manufacturer’s selling agent. The manufacturer, called the consignor, retains title until the goods are sold. Such merchandise is said to be shipped on consignment to the retailer, called the consignee. Any unsold merchandise at year-end is a part of the manufacturer’s (consignor’s) inventory, even though the merchandise is in the hands of the retailer (consignee). At year-end, it would be easy for the retailer (consignee) to incorrectly include the consigned merchandise in its physical inventory. Likewise, the manufacturer (consignor) should include consigned inventory in its physical inventory, even though the inventory is not on hand.

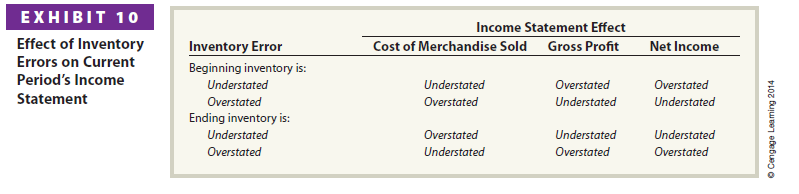

Income Statement Effects Inventory errors will misstate the income statement amounts for cost of merchandise sold, gross profit, and net income. The effects of inventory errors on the current period’s income statement are summarized in Exhibit 10.

To illustrate, the income statements of SysExpress shown in Exhibit 11 are used.5 On December 31, 2013, assume that SysExpress incorrectly records its physical inventory as $50,000 instead of the correct amount of $60,000. Thus, the December 31, 2013, inventory is understated by $10,000 ($60,000 – $50,000). As a result, the cost of merchandise sold is overstated by $10,000. The gross profit and the net income for the year will also be understated by $10,000.

The December 31, 2013, merchandise inventory becomes the January 1, 2014, inventory. Thus, the beginning inventory for 2014 is understated by $10,000. As a result, the cost of merchandise sold is understated by $10,000 for 2014. The gross profit and net income for 2014 will be overstated by $10,000.

As shown in Exhibit 11, since the ending inventory of one period is the beginning inventory of the next period, the effects of inventory errors carry forward to the next period. Specifically, if uncorrected, the effects of inventory errors reverse themselves in the next period. In Exhibit 11, the combined net income for the two years of $525,000 is correct, even though the 2013 and 2014 income statements were incorrect.

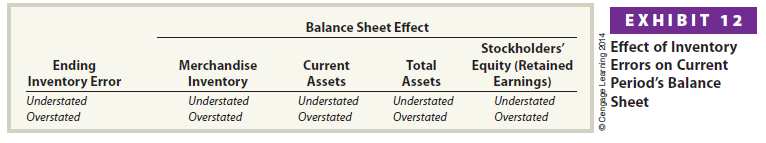

Balance Sheet Effects Inventory errors misstate the merchandise inventory, current assets, total assets, and stockholders’ equity on the balance sheet. The effects of inventory errors on the current period’s balance sheet are summarized in Exhibit 12.

For the SysExpress illustration shown in Exhibit 11, the December 31, 2013, ending inventory was understated by $10,000. As a result, the merchandise inventory, current assets, and total assets would be understated by $10,000 on the December 31, 2013, balance sheet. Because the ending physical inventory is understated, the cost of merchandise sold for 2013 will be overstated by $10,000. Thus, the gross profit and the net income for 2013 are understated by $10,000. Since the net income is closed to stockholders’ equity (Retained Earnings) at the end of the period, the stockholders’ equity on the December 31, 2013, balance sheet is also understated by $10,000.

As discussed above, inventory errors reverse themselves within two years. As a result, the balance sheet will be correct as of December 31, 2014. Using the SysExpress illustration from Exhibit 11, these effects are summarized on the next page.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

As a Newbie, I am permanently searching online for articles that can aid me. Thank you