The two main sources of stockholders’ equity are paid-in capital (or contributed capital) and retained earnings. The main source of paid-in capital is from issuing stock.

1. Characteristics of Stock

The number of shares of stock that a corporation is authorized to issue is stated in its charter. The term issued refers to the shares issued to the stockholders. A corporation may reacquire some of the stock that it has issued. The stock remaining in the hands of stockholders is then called outstanding stock. The relationship between authorized, issued, and outstanding stock is shown in the graphic at the right.

Upon request, corporations may issue stock certificates to stockholders to document their ownership. Printed on a stock certificate is the name of the company, the name of the stockholder, and the number of shares owned. The stock certificate may also indicate a dollar amount assigned to each share of stock, called par value. Stock may be issued without par, in which case it is called no-par stock. In some states, the board of directors of a corporation is required to assign a stated value to no-par stock.

Corporations have limited liability and, thus, creditors have no claim against stockholders’ personal assets. To protect creditors, however, some states require corporations to maintain a minimum amount of paid-in capital. This minimum amount, called legal capital, usually includes the par or stated value of the shares issued.

The major rights that accompany ownership of a share of stock are as follows:

- The right to vote in matters concerning the corporation.

- The right to share in distributions of earnings.

- The right to share in assets upon liquidation.

These stock rights normally vary with the class of stock.

2. Classes of Stock

When only one class of stock is issued, it is called common stock. Each share of common stock has equal rights.

A corporation may also issue one or more classes of stock with various preference rights such as a preference to dividends. Such a stock is called a preferred stock. The dividend rights of preferred stock are stated either as dollars per share or as a percent of par. For example, a $50 par value preferred stock with a $4 per share dividend may be described as either:3

preferred $4 stock, $50 par

or

preferred 8% stock, $50 par

Because they have first rights (preference) to any dividends, preferred stockholders have a greater chance of receiving dividends than common stockholders. However, since dividends are normally based on earnings, a corporation cannot guarantee dividends even to preferred stockholders.

The payment of dividends is authorized by the corporation’s board of directors. When authorized, the directors are said to have declared a dividend.

Cumulative preferred stock has a right to receive regular dividends that were not declared (paid) in prior years.

Noncumulative preferred stock does not have this right.

Cumulative preferred stock dividends that have not been paid in prior years are said to be in arrears. Any preferred dividends in arrears must be paid before any common stock dividends are paid. In addition, any dividends in arrears are normally disclosed in notes to the financial statements.

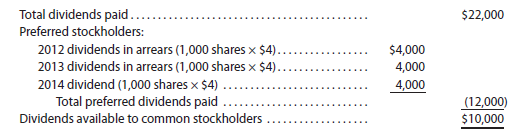

To illustrate, assume that a corporation has issued the following preferred and common stock:

1000 shares of cumulative preferred $4 stock, $50 par

4000 shares of common stock, $15 par

The corporation was organized on January 1, 2012, and paid no dividends in 2012 and 2013. In 2014, the corporation paid $22,000 in dividends, of which $12,000 was paid to preferred stockholders and $10,000 was paid to common stockholders as shown below.

As a result, preferred stockholders received $12.00 per share ($12,000 f 1,000 shares) in dividends, while common stockholders received $2.50 per share ($10,000 f 4,000 shares).

In addition to dividend preference, preferred stock may be given preferences to assets if the corporation goes out of business and is liquidated. However, claims of creditors must be satisfied first. Preferred stockholders are next in line to receive any remaining assets, followed by the common stockholders.

3. Issuing Stock

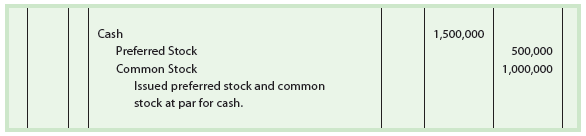

A separate account is used for recording the amount of each class of stock issued to investors in a corporation. For example, assume that a corporation is authorized to issue 10,000 shares of $100 par preferred stock and 100,000 shares of $20 par common stock. The corporation issued 5,000 shares of preferred stock and 50,000 shares of common stock at par for cash. The corporation’s entry to record the stock issue is as follows:

Stock is often issued by a corporation at a price other than its par. The price at which stock is sold depends on a variety of factors, such as the following:

- The financial condition, earnings record, and dividend record of the corporation.

- Investor expectations of the corporation’s potential earning power.

- General business and economic conditions and expectations.

If stock is issued (sold) for a price that is more than its par, the stock has been sold at a premium. For example, if common stock with a par of $50 is sold for $60 per share, the stock has sold at a premium of $10.

If stock is issued (sold) for a price that is less than its par, the stock has been sold at a discount. For example, if common stock with a par of $50 is sold for $45 per share, the stock has sold at a discount of $5. Many states do not permit stock to be sold at a discount. In other states, stock may be sold at a discount in only unusual cases. Since stock is rarely sold at a discount, it is not illustrated.

In order to distribute dividends, financial statements, and other reports, a corporation must keep track of its stockholders. Large public corporations normally use a financial institution, such as a bank, for this purpose.5 In such cases, the financial institution is referred to as a transfer agent or registrar.

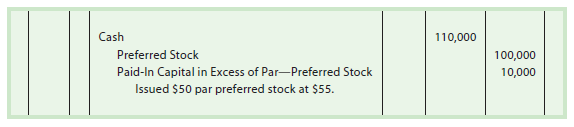

4. Premium on Stock

When stock is issued at a premium, Cash is debited for the amount received. Common Stock or Preferred Stock is credited for the par amount. The excess of the amount paid over par is part of the paid-in capital. An account entitled Paid-In Capital in Excess of Par is credited for this amount.

To illustrate, assume that Caldwell Company issues 2,000 shares of $50 par preferred stock for cash at $55. The entry to record this transaction is as follows:

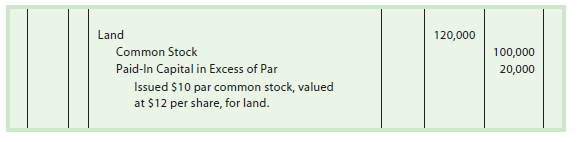

When stock is issued in exchange for assets other than cash, such as land, buildings, and equipment, the assets acquired are recorded at their fair market value. If this value cannot be determined, the fair market price of the stock issued is used.

To illustrate, assume that a corporation acquired land with a fair market value that cannot be determined. In exchange, the corporation issued 10,000 shares of its $10 par common stock. If the stock has a market price of $12 per share, the transaction is recorded as follows:

5. No-Par Stock

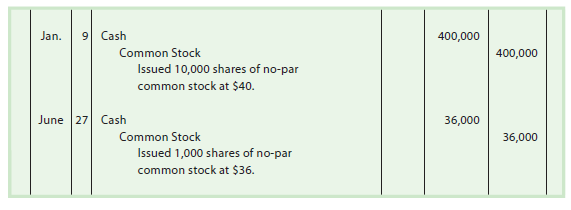

In most states, no-par preferred and common stock may be issued. When no-par stock is issued, Cash is debited and Common Stock is credited for the proceeds. As no-par stock is issued over time, this entry is the same even if the issuing price varies.

To illustrate, assume that on January 9 a corporation issues 10,000 shares of no-par common stock at $40 a share. On June 27, the corporation issues an additional 1,000 shares at $36. The entries to record these issuances of the no-par stock are as follows:

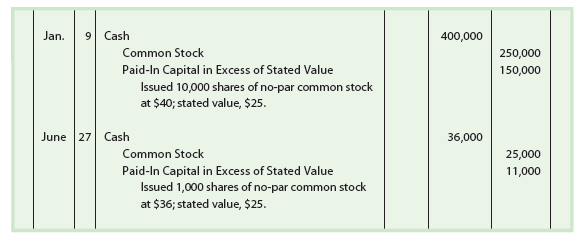

In some states, no-par stock may be assigned a stated value per share. The stated value is recorded like a par value. Any excess of the proceeds over the stated value is credited to Paid-In Capital in Excess of Stated Value.

To illustrate, assume that in the preceding example the no-par common stock is assigned a stated value of $25. The issuance of the stock on January 9 and June 27 is recorded as follows:

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I’m impressed, I must say. Actually not often do I encounter a blog that’s both educative and entertaining, and let me let you know, you could have hit the nail on the head. Your concept is excellent; the issue is one thing that not enough persons are talking intelligently about. I am very comfortable that I stumbled across this in my search for something relating to this.

Its wonderful as your other blog posts : D, regards for putting up.