Fixed assets are long-term or relatively permanent assets such as equipment, machinery, buildings, and land. Other descriptive titles for fixed assets are plant assets or property, plant, and equipment. Fixed assets have the following characteristics:

- They exist physically and, thus, are tangible

- They are owned and used by the company in its normal operations.

- They are not offered for sale as part of normal operations.

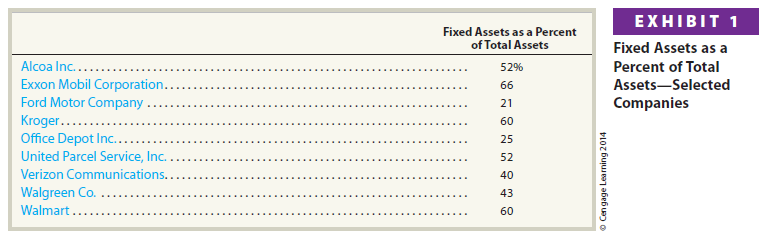

Exhibit 1 shows the percent of fixed assets to total assets for some select companies. As shown in Exhibit 1, fixed assets are often a significant portion of the total assets of a company.

1. Classifying Costs

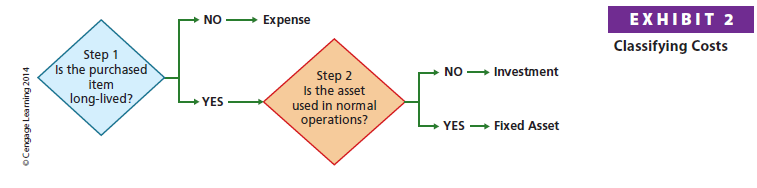

A cost that has been incurred may be classified as a fixed asset, an investment, or an expense. Exhibit 2 shows how to determine the proper classification of a cost and how it should be recorded.

As shown in Exhibit 2, classifying a cost involves the following steps:

Step 1.

Is the purchased item long-lived?

If yes, the item is recorded as an asset on the balance sheet, either as a

fixed asset or an investment. Proceed to Step 2.

If no, the item is classified and recorded as an expense.

Step 2.

Is the asset used in normal operations?

If yes, the asset is classified and recorded as a fixed asset.

If no, the asset is classified and recorded as an investment.

Items that are classified and recorded as fixed assets include land, buildings, or equipment. Such assets normally last more than a year and are used in the normal operations. However, standby equipment for use during peak periods or when other equipment breaks down is still classified as a fixed asset, even though it is not used very often. In contrast, fixed assets that have been abandoned or are no longer used in operations are not classified as fixed assets.

Although fixed assets may be sold, they should not be offered for sale as part of normal operations. For example, cars and trucks offered for sale by an automotive dealership are not fixed assets of the dealership. On the other hand, a tow truck used in the normal operations of the dealership is a fixed asset of the dealership.

Investments are long-lived assets that are not used in the normal operations and are held for future resale. Such assets are reported on the balance sheet in a section entitled Investments. For example, undeveloped land acquired for future resale would be classified and reported as an investment, not land.

2. The Cost of Fixed Assets

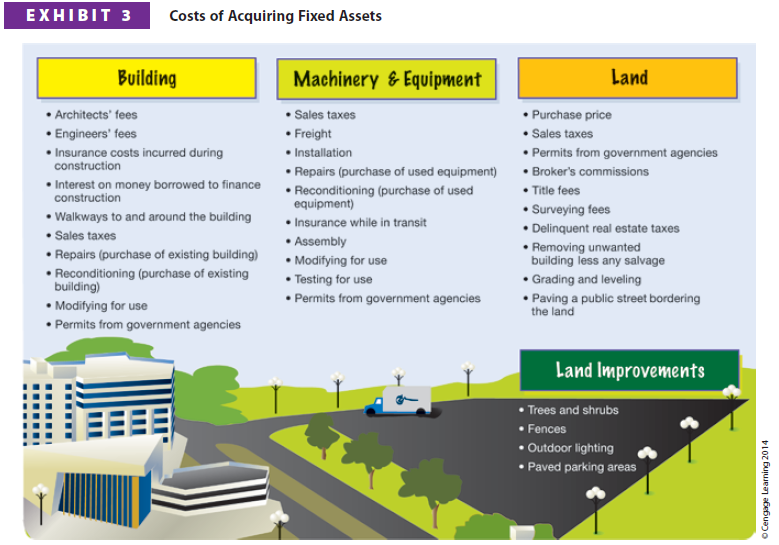

In addition to purchase price, the costs of acquiring fixed assets include all amounts spent getting the asset in place and ready for use. For example, freight costs and the costs of installing equipment are part of the asset’s total cost.

Exhibit 3 summarizes some of the common costs of acquiring fixed assets. These costs are recorded by debiting the related fixed asset account, such as Land,[1] Building, Land Improvements, or Machinery and Equipment.

Costs of Acquiring Fixed Assets

Only costs necessary for preparing the fixed asset for use are included as a cost of the asset. Unnecessary costs that do not increase the asset’s usefulness are recorded as an expense. For example, the following costs are included as an expense:

- Vandalism

- Mistakes in installation

- Uninsured theft

- Damage during unpacking and installing

- Fines for not obtaining proper permits from governmental agencies

A company may incur costs associated with constructing a fixed asset such as a new building. The direct costs incurred in the construction, such as labor and materials, should be capitalized as a debit to an account entitled Construction in Progress. When the construction is complete, the costs are reclassified by crediting Construction in Progress and debiting the proper fixed asset account such as Building. For some companies, construction in progress can be significant.

3. Capital and Revenue Expenditures

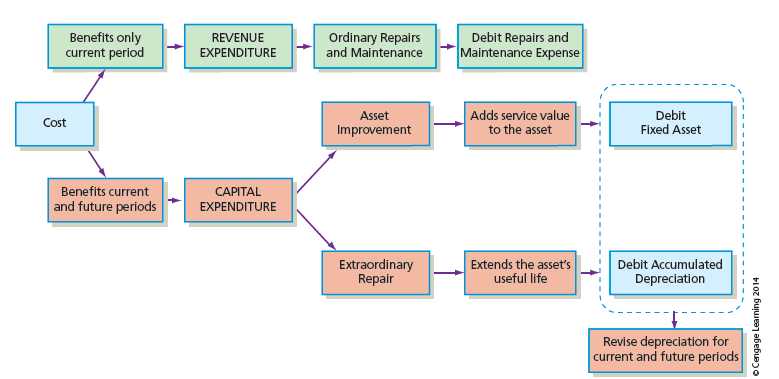

Once a fixed asset has been acquired and placed into service, costs may be incurred for ordinary maintenance and repairs. In addition, costs may be incurred for improving an asset or for extraordinary repairs that extend the asset’s useful life. Costs that benefit only the current period are called revenue expenditures. Costs that improve the asset or extend its useful life are capital expenditures.

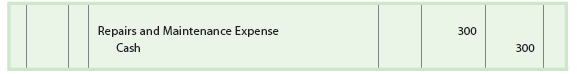

Ordinary Maintenance and Repairs Costs related to the ordinary maintenance and repairs of a fixed asset are recorded as an expense of the current period. Such expenditures are revenue expenditures and are recorded as increases to Repairs and Maintenance Expense. For example, $300 paid for a tune-up of a delivery truck is recorded as follows:

Asset Improvements After a fixed asset has been placed into service, costs may be incurred to improve the asset. For example, the service value of a delivery truck might be improved by adding a $5,500 hydraulic lift to allow for easier and quicker loading of cargo. Such costs are capital expenditures and are recorded as increases to the fixed asset account. In the case of the hydraulic lift, the expenditure is recorded as follows:

Because the cost of the delivery truck has increased, depreciation for the truck will also change over its remaining useful life.

Extraordinary Repairs After a fixed asset has been placed into service, costs may be incurred to extend the asset’s useful life. For example, the engine of a forklift that is near the end of its useful life may be overhauled at a cost of $4,500, extending its useful life by eight years. Such costs are capital expenditures and are recorded as a decrease in an accumulated depreciation account. In the case of the forklift, the expenditure is recorded as follows:

Because the forklift’s remaining useful life has changed, depreciation for the forklift will also change based on the new book value of the forklift.

The accounting for revenue and capital expenditures is summarized below.

4. Leasing Fixed Assets

A lease is a contract for the use of an asset for a period of time. Leases are often used in business. For example, automobiles, computers, medical equipment, buildings, and airplanes are often leased.

The two parties to a lease contract are as follows:

- The lessor is the party who owns the asset.

- The lessee is the party to whom the rights to use the asset are granted by the lessor.

Under a lease contract, the lessee pays rent on a periodic basis for the lease term. The lessee accounts for a lease contract in one of two ways depending on how the lease contract is classified. A lease contract can be classified as either:

- A capital lease or

- An operating lease

A capital lease is accounted for as if the lessee has purchased the asset. The lessee debits an asset account for the fair market value of the asset and credits a long-term lease liability account. The asset is then written off as an expense (amortized) over the life of the capital lease. The accounting for capital leases is discussed in more advanced accounting texts.

An operating lease is accounted for as if the lessee is renting the asset for the lease term. The lessee records operating lease payments by debiting Rent Expense and crediting Cash. The lessee’s future lease obligations are not recorded in the accounts. However, such obligations are disclosed in notes to the financial statements.

The asset rentals described in earlier chapters of this text were accounted for as operating leases. To simplify, all leases are assumed to be operating leases throughout this text.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I have not checked in here for some time because I thought it was getting boring, but the last several posts are great quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂