A business may need to estimate the amount of inventory for the following reasons:

- Perpetual inventory records are not maintained.

- A disaster such as a fire or flood has destroyed the inventory records and the inventory.

- Monthly or quarterly financial statements are needed, but a physical inventory is taken only once a year.

This appendix describes and illustrates two widely used methods of estimating inventory cost.

1. Retail Method of Inventory Costing

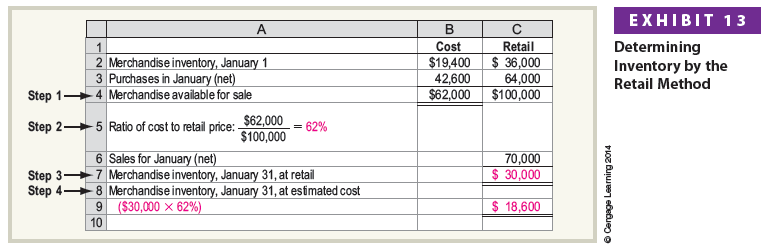

The retail inventory method of estimating inventory cost requires costs and retail prices to be maintained for the merchandise available for sale. A ratio of cost to retail price is then used to convert ending inventory at retail to estimate the ending inventory cost. The retail inventory method is applied as follows:

- Step 1. Determine the total merchandise available for sale at cost and retail.

- Step 2. Determine the ratio of the cost to retail of the merchandise available for sale.

- Step 3. Determine the ending inventory at retail by deducting the net sales from the merchandise available for sale at retail.

- Step 4. Estimate the ending inventory cost by multiplying the ending inventory at retail by the cost to retail ratio.

Exhibit 13 illustrates the retail inventory method.

When estimating the cost to retail ratio, the mix of items in the ending inventory is assumed to be the same as the merchandise available for sale. If the ending inventory is made up of different classes of merchandise, cost to retail ratios may be developed for each class of inventory.

An advantage of the retail method is that it provides inventory figures for preparing monthly statements. Department stores and similar retailers often determine gross profit and operating income each month, but may take a physical inventory only once or twice a year. Thus, the retail method allows management to monitor operations more closely.

The retail method may also be used as an aid in taking a physical inventory. In this case, the items are counted and recorded at their retail (selling) prices instead of their costs. The physical inventory at retail is then converted to cost by using the cost to retail ratio.

2. Gross Profit Method of Inventory Costing

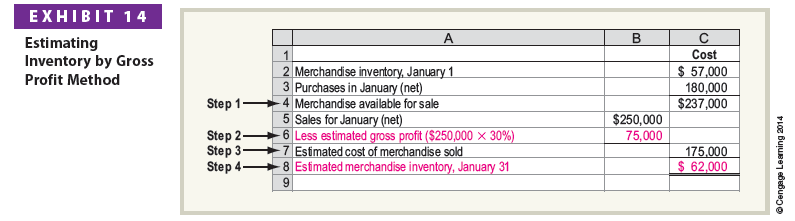

The gross profit method uses the estimated gross profit for the period to estimate the inventory at the end of the period. The gross profit is estimated from the preceding year, adjusted for any current-period changes in the cost and sales prices.

The gross profit method is applied as follows:

- Step 1. Determine the merchandise available for sale at cost.

- Step 2. Determine the estimated gross profit by multiplying the net sales by the gross profit percentage.

- Step 3. Determine the estimated cost of merchandise sold by deducting the estimated gross profit from the net sales.

- Step 4. Estimate the ending inventory cost by deducting the estimated cost of merchandise sold from the merchandise available for sale.

Exhibit 14 illustrates the gross profit method.

The gross profit method is useful for estimating inventories for monthly or quarterly financial statements. It is also useful in estimating the cost of merchandise destroyed by fire or other disasters.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Hello, Neat post. There is an issue along with your web site in internet explorer, may check thisK IE still is the market leader and a big part of other people will miss your fantastic writing because of this problem.