A stock split is a process by which a corporation reduces the par or stated value of its common stock and issues a proportionate number of additional shares. A stock split applies to all common shares including the unissued, issued, and treasury shares.

A major objective of a stock split is to reduce the market price per share of the stock. This attracts more investors and broadens the types and numbers of stockholders.

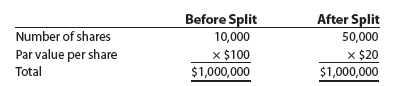

To illustrate, assume that Rojek Corporation has 10,000 shares of $100 par common stock outstanding with a current market price of $150 per share. The board of directors declares the following stock split:

- Each common shareholder will receive 5 shares for each share held. This is called a 5-for-l stock split. As a result, 50,000 shares (10,000 shares x 5) will be outstanding.

- The par of each share of common stock will be reduced to $20 ($100/5).

The par value of the common stock outstanding is $1,000,000 both before and after the stock split as shown below.

In addition, each Rojek Corporation shareholder owns the same total par amount of stock before and after the stock split. For example, a stockholder who owned 4 shares of $100 par stock before the split (total par of $400) would own 20 shares of $20 par stock after the split (total par of $400). Only the number of shares and the par value per share have changed.

Since there are more shares outstanding after the stock split, the market price of the stock should decrease. For example, in the preceding example, there would be 5 times as many shares outstanding after the split. Thus, the market price of the stock would be expected to fall from $150 to about $30 ($150 f 5).

Stock splits do not require a journal entry, since only the par (or stated) value and number of shares outstanding have changed. However, the details of stock splits are normally disclosed in the notes to the financial statements.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021