For operating leases, the decision centers on “lease versus buy.” For financial leases, the decision amounts to “lease versus borrow.” Financial leases extend over most of the economic life of the leased equipment. They are not cancelable. The lease payments are fixed obligations equivalent to debt service.

Financial leases make sense when the company is prepared to take on the business risks of owning and operating the leased asset. If Establishment Industries signs a financial lease for the stretch limo, it is stuck with that asset. The financial lease is just another way of borrowing money to pay for the limo.

Financial leases do offer special advantages to some firms in some circumstances. However, there is no point in further discussion of these advantages until you know how to value financial lease contracts.

1. Example of a Financial Lease

Imagine yourself in the position of Thomas Pierce III, president of Greymare Bus Lines. Your firm was established by your grandfather, who was quick to capitalize on the growing demand for transportation between Widdicombe and nearby townships. The company has owned all its vehicles from the time the company was formed; you are now reconsidering that policy. Your operating manager wants to buy a new bus costing $100,000. The bus will last only eight years before going to the scrap yard. You are convinced that investment in the additional equipment is worthwhile. However, the representative of the bus manufacturer has pointed out that her firm would also be willing to lease the bus to you for eight annual payments of $16,200 each. Greymare would remain responsible for all maintenance, insurance, and operating expenses.

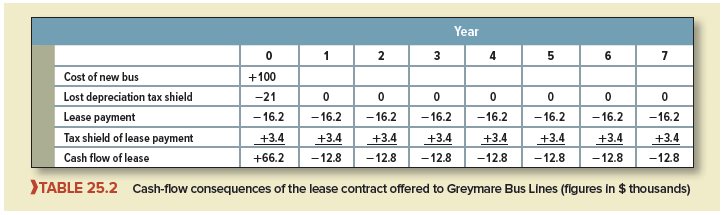

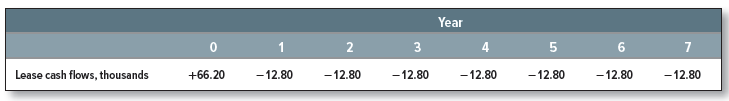

Table 25.2 shows the direct cash-flow consequences of signing the lease contract. (An important indirect effect is considered later.) The consequences are as follows:

- Greymare does not have to pay for the bus. This is equivalent to a cash inflow of $100,000.

- Greymare no longer owns the bus and so cannot depreciate it. Therefore it gives up a valuable depreciation tax shield. In Table 25.2, we have assumed that the bus could be written-off immediately for tax.

- Greymare must pay $16,200 per year for eight years to the lessor. The first payment is due immediately and the last at the end of year 7.

- However, these lease payments are fully tax-deductible. At a 21% marginal tax rate, the lease payments generate tax shields of $3,400 per year. You could say that the after-tax cost of the lease payment is $16,200 – $3,400 = $12,800.

We must emphasize that Table 25.2 assumes that Greymare will pay taxes at the full 21% marginal rate. If the firm were sure to lose money, and therefore pay no taxes, lines 2 and 4 would be left blank. The depreciation tax shields are worth nothing to a firm that pays no taxes, for example.

Table 25.2 also assumes the bus will be worthless when it goes to the scrap yard at the end of year 7. Otherwise there would be an entry for salvage value lost.

Warning: Notice also that we assume for simplicity that all the cash flows occur on just one day each year. So today, Greymare saves the cost of buying the bus, makes the up-front lease payment, and settles up any tax consequences. Exactly 365 days later, it makes a further lease payment and pays $3,400 less in taxes. Elsewhere in the book, we have made similar simplifying assumptions, but leasing is a business with narrow margins; when you need to calculate the value of a lease, it pays to be precise about the exact timing of each cash flow.

1. Who Really Owns the Leased Asset?

To a lawyer or a tax accountant, that would be a silly question: The lessor is clearly the legal owner of the leased asset. That is why the lessor is allowed to deduct depreciation from taxable income.

From an economic point of view, you might say that the user is the real owner because, in a financial lease, the user faces the risks and receives the rewards of ownership. Greymare cannot cancel a financial lease. If the new bus turns out to be hopelessly costly and unsuited for Greymare’s routes, that is Greymare’s problem, not the lessor’s. If it turns out to be a great success, the profit goes to Greymare, not the lessor. The success or failure of the firm’s business operations does not depend on whether the buses are financed by leasing or some other financial instrument.

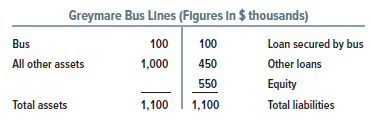

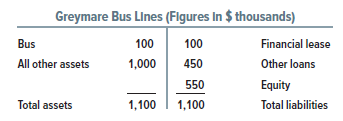

In many respects, a financial lease is equivalent to a secured loan. The lessee must make a series of fixed payments; if the lessee fails to do so, the lessor can repossess the asset. Thus, we can think of a balance sheet like this:

as being economically equivalent to a balance sheet like this:

Having said this, we must immediately qualify. Legal ownership can make a big difference when a financial lease expires because the lessor gets the asset. Once a secured loan is paid off, the user owns the asset free and clear.

2. Leasing and the Internal Revenue Service

We have already noted that the lessee loses the tax depreciation of the leased asset but can deduct the lease payment in full. The lessor, as legal owner, uses the depreciation tax shield but must report the lease payments as taxable rental income.

However, the Internal Revenue Service is suspicious by nature and will not allow the lessee to deduct the entire lease payment unless it is satisfied that the arrangement is a genuine lease and not a disguised installment purchase or secured loan agreement.[1]

Some leases are designed not to qualify as a true lease for tax purposes. Suppose a manufacturer finds it convenient to lease a new computer but wants to keep the depreciation tax shields. This is easily accomplished by giving the manufacturer the option to purchase the computer for $1 at the end of the lease.[2] Then the Internal Revenue Service treats the lease as an installment sale, and the manufacturer can deduct depreciation and the interest component of the lease payment for tax purposes. But the lease is still a lease for all other purposes.

3. A First Pass at Valuing a Lease Contract

When we left Thomas Pierce III, president of Greymare Bus Lines, he had just set down in Table 25.2 the cash flows of the financial lease proposed by the bus manufacturer.

These cash flows are typically assumed to be about as safe as the interest and principal payments on a secured loan issued by the lessee. This assumption is reasonable for the lease payments because the lessor is effectively lending money to the lessee. But the various tax shields might carry enough risk to deserve a higher discount rate. For example, Greymare might be confident that it could make the lease payments but not confident that it could earn enough taxable income to use these tax shields. In that case, the cash flows generated by the tax shields would probably deserve a higher discount rate than the borrowing rate used for the lease payments.

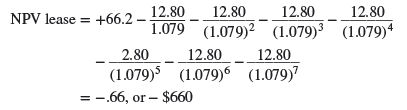

A lessee might, in principle, end up using a separate discount rate for each line of Table 25.2, each rate chosen to fit the risk of that line’s cash flow. But established, profitable firms usually find it reasonable to simplify by discounting the types of flows shown in Table 25.2 at a single rate based on the rate of interest the firm would pay if it borrowed rather than leased. We assume Greymare’s borrowing rate is 10%.

At this point, we must go back to our discussion in the Appendix to Chapter 19 of debt- equivalent flows. When a company lends money, it pays tax on the interest it receives. Its net return is the after-tax interest rate. When a company borrows money, it can deduct interest payments from its taxable income. The net cost of borrowing is the after-tax interest rate. Thus the after-tax interest rate is the effective rate at which a company can transfer debt- equivalent flows from one time period to another. Therefore, to value the incremental cash flows stemming from the lease, we need to discount them at the after-tax interest rate.

Since Greymare can borrow at 10%, we should discount the lease cash flows at rD(1 – Tc) = .10(1 – .21) = .079, or 7.9%. This gives

Since the lease has a negative NPV, Greymare is better off buying the bus.

A positive or negative NPV is not an abstract concept; in this case Greymare’s shareholders really are $660 poorer if the company leases. Let us now check how this situation comes about.

Look once more at Table 25.2. The lease cash flows are

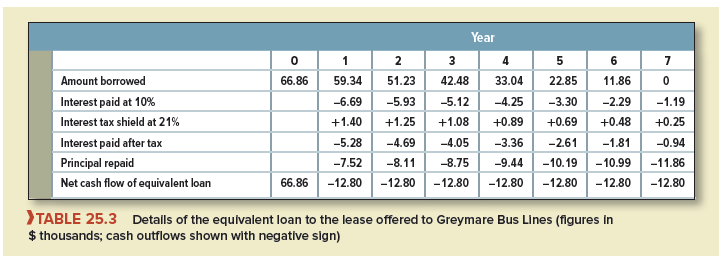

The lease payments are contractual obligations like the principal and interest payments on secured debt. Thus, you can think of the incremental lease cash flows in years 1 through 7 as the “debt service” of the lease. Table 25.3 shows a loan with exactly the same debt service as the lease. The initial amount of the loan is $66.86 thousand. If Greymare borrowed this sum, it would need to pay interest in the first year of .10 X 66.86 = 6.69 and would receive a tax shield on this interest of .21 X 6.69 = 1.40. Greymare could then repay 7.52 of the loan, leaving a net cash outflow of 12.80 (exactly the same as for the lease) in year 1 and an outstanding debt at the start of year 2 of 59.34.

As you walk through the calculations in Table 25.3, you see that it costs exactly the same to service a loan that brings an immediate inflow of 66.86 as it does to service the lease, which brings in only 66.20. That is why we say that the lease has a net present value of 66.86 – 66.20 = -.66, or -$660. If Greymare leases the bus rather than raising an equivalent loan, there will be $660 less in Greymare’s bank account.

Our example illustrates two general points about leases and equivalent loans. First, if you can devise a borrowing plan that gives the same cash flow as the lease in every future period but a higher immediate cash flow, then you should not lease. If, however, the equivalent loan provides the same future cash outflows as the lease but a lower immediate inflow, then leasing is the better choice.

Second, our example suggests two ways to value a lease:

- Hard way. Construct a table like Table 25.3 showing the equivalent loan.

- Easy way. Discount the lease cash flows at the after-tax interest rate that the firm would pay on an equivalent loan. Both methods give the same answer—in our case an NPV of -$660.[3]

4. The Story So Far

We concluded that the lease contract offered to Greymare Bus Lines was not attractive because the lease provided $660 less financing than the equivalent loan. The underlying principle is as follows: A financial lease is superior to buying and borrowing if the financing provided by the lease exceeds the financing generated by the equivalent loan.

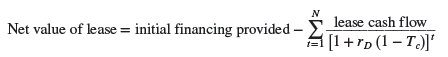

The principle implies this formula:

where N is the length of the lease. Initial financing provided equals the cost of the leased asset minus any immediate lease payment or other cash outflow attributable to the lease.[4]

Notice that the value of the lease is its incremental value relative to borrowing via an equivalent loan. A positive lease value means that if you acquire the asset, lease financing is advantageous. It does not prove you should acquire the asset.

However, sometimes favorable lease terms rescue a capital investment project. Suppose that Greymare had decided against buying a new bus because the NPV of the $100,000 investment was -$5,000 assuming normal financing. The bus manufacturer could rescue the deal by offering a lease with a value of, say, +$8,000. By offering such a lease, the manufacturer would in effect cut the price of the bus to $92,000, giving the bus-lease package a positive value to Greymare. We could express this more formally by treating the lease’s NPV as a favorable financing side effect that adds to project adjusted present value (APV):[5]

APV = NPV of project + NPV of lease = -5,000 + 8,000 = +$3,000

Notice also that our formula applies to net financial leases. Any insurance, maintenance, and other operating costs picked up by the lessor have to be evaluated separately and added to the value of the lease. If the asset has salvage value at the end of the lease, that value should be taken into account also.

Suppose, for example, that the bus manufacturer offers to provide routine maintenance that would otherwise cost $2,000 per year after tax. However, Mr. Pierce reconsiders and decides that the bus will probably be worth $10,000 after eight years. (Previously he assumed the bus would be worthless at the end of the lease.) Then the value of the lease increases by the present value of the maintenance savings and decreases by the present value of the lost salvage value.

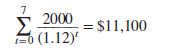

Maintenance and salvage value are harder to predict than the cash flows shown in Table 25.2, and normally deserve a higher discount rate. Suppose that Mr. Pierce uses 12%. Then the maintenance savings are worth

The lost salvage value is worth $10,000/(1.12)8 = $4,000. Remember that we previously calculated the value of the lease as -$660. The revised value is, therefore,-660 + 11,100 – 4,000= $6,550. Now the lease looks like a good deal.

5. Financial Leases When There Is No Interest Tax Shield

In Table 25.3, we devised a loan that Greymare could take out that had exactly the same cash flows as the lease. In that table, we assumed that Greymare could deduct the interest on this loan when it calculated its taxable income. But the 2017 Tax Cuts and Jobs Act limited the amount of interest that companies can deduct to 30% of earnings before interest and depreciation. Suppose that Greymare has borrowed heavily and cannot deduct additional interest payments for tax. This restriction applies to interest expense on borrowing by Greymare but not to lease payments, even though they are equivalent to debt service. Therefore, leasing the bus allows Greymare to sidestep the restriction on interest deductibility.

If Greymare borrows to finance the bus, it will not enjoy any interest tax shields until its earnings recover. So the cost of debt during this period is no longer equal to the after-tax interest rate, and it no longer makes sense to value the lease cash flows by discounting them at this rate. Since the easy way to value the lease doesn’t work, you need to turn to the hard way and calculate how much Greymare could borrow if it set aside the future lease cash flows to service the loan. If the amount that Greymare could borrow is less than the immediate cash inflow on the lease, then leasing is the better option.[7]

24 Jun 2021

25 Jun 2021

24 Jun 2021

23 Jun 2021

23 Jun 2021

24 Jun 2021