Calculating Landed Cost and Distributor/Retail Price

There are two steps involved in calculating the export price:

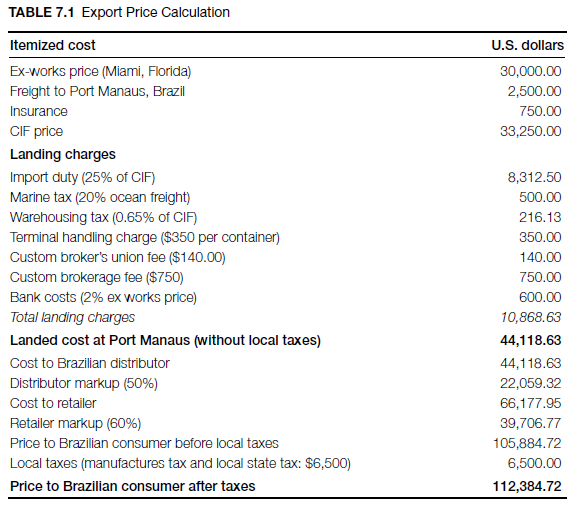

- Calculating the landed cost: Landed cost is the total cost of a product once it has arrived at the buyer’s door. It includes the original cost of the item, all brokerage and logistics fees, complete shipping costs, customs duties, taxes, insurance, currency conversion, crating costs, and handling fees. Not all of these components are present in every shipment. It is advantageous to reduce the cost of each or any component of landed cost. This will allow the seller to lower the final selling price or increase the margin associated with that sale (Table 7.1).

- Calculating the distributor’s and retailer’s price: Every industry has a standard markup from cost to price. In the gifts and house wares industry, for example, the standard markup is 100 percent. In other industries, it ranges from 35 percent to 60 percent (Table 7.1).

Illustrative Example

A U.S. manufacturer exports medical equipment from Miami, Florida, to a distributor in Brazil.

Selling price: $30,000

Terms of sale: Ex-works, Miami, Florida

Payment method: Open account

Assessing price competitiveness: This method compares the price competitiveness of the U.S. export item sold in Brazil with that of a similar (competing) product produced in Brazil and Uruguay. Uruguay is a member of the MERCOSUR customs union, which also includes Brazil, Argentina, and Paraguay. The trade agreement eliminates all tariffs and nontariff barriers among member nations. This means that the exporters from Uruguay to Brazil do not pay import duties.

Assuming that both competitors can produce the product at $30,000, the Brazilian and Uruguayan producer will have a tremendous cost advantage over the U.S. exporter: a difference of $33,885 and $26,970, respectively. The price difference (between the U.S. and Brazilian product) is a result of freight costs and customs duties, while the price advantage enjoyed by the exporter from Uruguay is largely attributed to nonimposition of tariffs (Table 7.2).

Improving the odds and achieving export competitiveness: There are a number of potential options for U.S. exporters that find themselves in an uncompetitive position in foreign markets. With the assistance of their home government, they can devise strategies that will contribute to enhancing their competitiveness.

Long-term options:

- Free-trade agreements will help reduce or eliminate tariffs and nontariff barriers.

- Foreign direct investment will eliminate the additional cost of import duties. Locally produced components can be assembled into a final product in the export market.

- A manufacturer can license the use of its technology for production in the export market.

Short-term options:

- Long distribution channels contribute to price escalation. You can shorten the channel or export through an overseas representative.

- Product differentiation: Successful product differentiation creates a competitive advantage for the seller, as customers view these products as unique or superior. Product differentiation provides the firm some autonomy in its price-setting objectives.

- Discounts tied to promotions or quantity discounts can improve competitiveness.

Source: Seyoum Belay (2014), Export-import theory, practices, and procedures, Routledge; 3rd edition.

all the time i used to read smaller posts that as well clear their motive, and that is also

happening with this post which I am reading at this time.