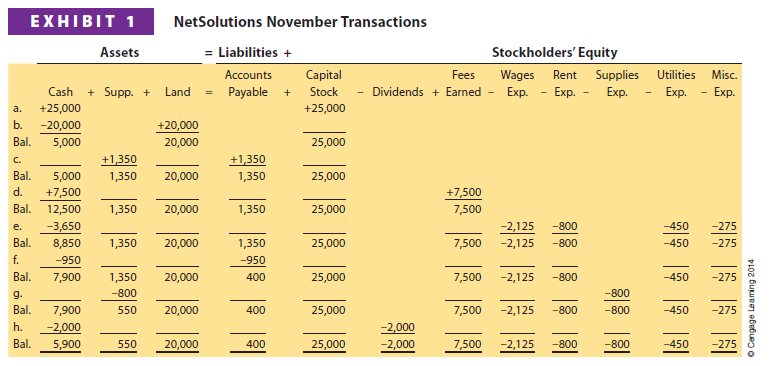

In Chapter 1, the November transactions for NetSolutions were recorded using the accounting equation format shown in Exhibit 1. However, this format is not efficient or practical for companies that have to record thousands or millions of transactions daily. As a result, accounting systems are designed to show the increases and decreases in each accounting equation element as a separate record. This record is called an account.

To illustrate, the Cash column of Exhibit 1 records the increases and decreases in cash. Likewise, the other columns in Exhibit 1 record the increases and decreases in the other accounting equation elements. Each of these columns can be organized into a separate account.

An account, in its simplest form, has three parts.

- A title, which is the name of the accounting equation element recorded in the account.

- A space for recording increases in the amount of the element.

- A space for recording decreases in the amount of the element.

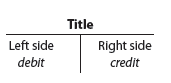

The account form presented below is called a T account because it resembles the letter T. The left side of the account is called the debit side, and the right side is called the credit side.1

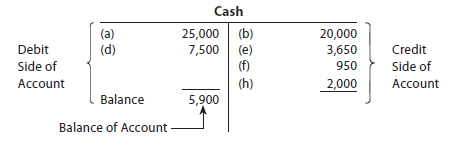

The amounts shown in the Cash column of Exhibit 1 would be recorded in a cash account as follows:

The amounts shown in the Cash column of Exhibit 1 would be recorded in a cash account as follows:

Recording transactions in accounts must follow certain rules. For example, increases in assets are recorded on the debit (left side) of an account. Likewise, decreases in assets are recorded on the credit (right side) of an account. The excess of the debits of an asset account over its credits is the balance of the account.

To illustrate, the receipt (increase in Cash) of $25,000 in transaction (a) is entered on the debit (left) side of the cash account shown above. The letter or date of the transaction is also entered into the account. This is done so if any questions later arise related to the entry, the entry can be traced back to the underlying transaction data. In contrast, the payment (decrease in Cash) of $20,000 to purchase land in transaction (b) is entered on the credit (right) side of the account.

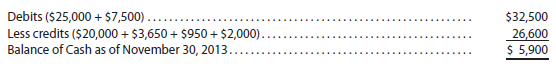

The balance of the cash account of $5,900 is the excess of the debits over the credits as shown below.

The balance of the cash account is inserted in the account, in the Debit column. In this way, the balance is identified as a debit balance.[1] This balance represents NetSolutions’ cash on hand as of November 30, 2013. This balance of $5,900 is reported on the November 30, 2013, balance sheet for NetSolutions as shown in Exhibit 6 of Chapter 1.

In an actual accounting system, a more formal account form replaces the T account. Later in this chapter, a four-column account is illustrated. The T account, however, is a simple way to illustrate the effects of transactions on accounts and financial statements. For this reason, T accounts are often used in business to explain transactions.

Each of the columns in Exhibit 1 can be converted into an account form in a similar manner as was done for the Cash column of Exhibit 1. However, as mentioned earlier, recording increases and decreases in accounts must follow certain rules. These rules are discussed after the chart of accounts is described.

Chart of Accounts

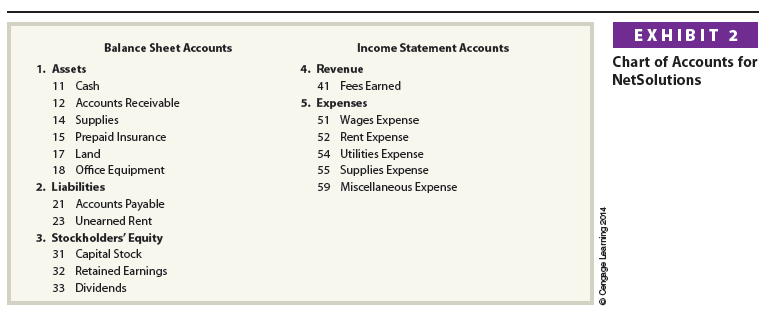

A group of accounts for a business entity is called a ledger. A list of the accounts in the ledger is called a chart of accounts. The accounts are normally listed in the order in which they appear in the financial statements. The balance sheet accounts are listed first, in the order of assets, liabilities, and stockholders’ equity. The income statement accounts are then listed in the order of revenues and expenses.

Assets are resources owned by the business entity. These resources can be physical items, such as cash and supplies, or intangibles that have value. Examples of intangible assets include patent rights, copyrights, and trademarks. Assets also include accounts receivable, prepaid expenses (such as insurance), buildings, equipment, and land.

Liabilities are debts owed to outsiders (creditors). Liabilities are often identified on the balance sheet by titles that include payable. Examples of liabilities include accounts payable, notes payable, and wages payable. Cash received before services are delivered creates a liability to perform the services. These future service commitments are called unearned revenues. Examples of unearned revenues include magazine subscriptions received by a publisher and tuition received at the beginning of a term by a college.

Stockholders’ equity is the stockholders’ right to the assets of the business. Stockholders’ equity is represented by the balance of the capital stock and retained earnings accounts. A dividends account represents distributions of earnings to stockholders.

Revenues are increases in stockholders’ equity as a result of selling services or products to customers. Examples of revenues include fees earned, fares earned, commissions revenue, and rent revenue.

Expenses result from using up assets or consuming services in the process of generating revenues. Examples of expenses include wages expense, rent expense, utilities expense, supplies expense, and miscellaneous expense.

A chart of accounts should meet the needs of a company’s managers and other users of its financial statements. The accounts within the chart of accounts are numbered for use as references. A numbering system is normally used, so that new accounts can be added without affecting other account numbers.

Exhibit 2 is NetSolutions’ chart of accounts that is used in this chapter. Additional accounts will be introduced in later chapters. In Exhibit 2, each account number has two digits. The first digit indicates the major account group of the ledger in which the account is located. Accounts beginning with 1 represent assets; 2, liabilities; 3, stockholders’ equity; 4, revenue; and 5, expenses. The second digit indicates the location of the account within its group.

Each of the columns in Exhibit 1 has been assigned an account number in the chart of accounts shown in Exhibit 2. In addition, Accounts Receivable, Prepaid Insurance, Office Equipment, and Unearned Rent have been added. These accounts will be used in recording NetSolutions’ December transactions.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021