In the United States and most other industrial countries, markets are rarely free of government intervention. Besides imposing taxes and granting subsidies, governments often regulate markets (even competitive markets) in a variety of ways. In this section, we will see how to use supply and demand curves to ana- lyze the effects of one common form of government intervention: price controls. Later, in Chapter 9, we will examine the effects of price controls and other forms of government intervention and regulation in more detail.

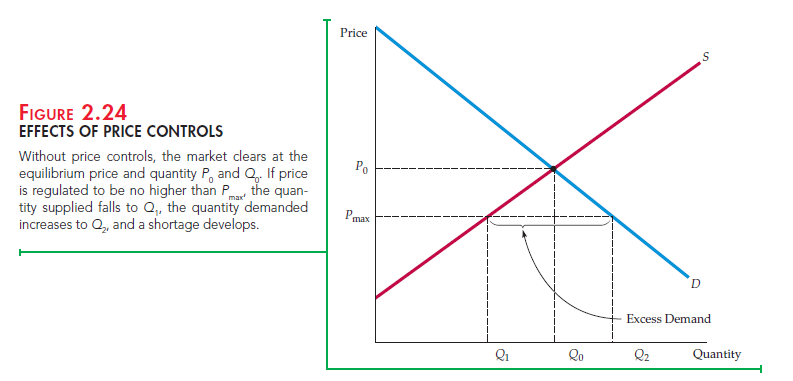

Figure 2.24 illustrates the effects of price controls. Here, P0 and Q0 are the equilibrium price and quantity that would prevail without government regulation. The government, however, has decided that P0 is too high and mandated that the price can be no higher than a maximum allowable ceil- ing price, denoted by Pmax. What is the result? At this lower price, producers (particularly those with higher costs) will produce less, and the quantity supplied will drop to Q1. Consumers, on the other hand, will demand more at this low price; they would like to purchase the quantity Q2. Demand there- fore exceeds supply, and a shortage develops—i.e., there is excess demand. The amount of excess demand is Q2 – Q1.

This excess demand sometimes takes the form of queues, as when drivers lined up to buy gasoline during the winter of 1974 and the summer of 1979. In both instances, the lines were the result of price controls; the government prevented domestic oil and gasoline prices from rising along with world oil prices. Sometimes excess demand results in curtailments and supply rationing, as with natural gas price controls and the resulting gas shortages of the mid-1970s, when industrial consumers closed factories because gas supplies were cut off. Sometimes it spills over into other markets, where it artificially increases demand. For example, natu- ral gas price controls caused potential buyers of gas to use oil instead.

Some people gain and some lose from price controls. As Figure 2.24 suggests, producers lose: They receive lower prices, and some leave the industry. Some but not all consumers gain. While those who can purchase the good at a lower price are better off, those who have been “rationed out” and cannot buy the good at all are worse off. How large are the gains to the winners and how large are the losses to the losers? Do total gains exceed total losses? To answer these ques- tions, we need a method to measure the gains and losses from price controls and other forms of government intervention. We discuss such a method in Chapter 9.

Very interesting information!Perfect just what I was searching for!