Much more common than pure monopsony are markets with only a few firms competing among themselves as buyers, so that each firm has some monop- sony power. For example, the major U.S. automobile manufacturers compete with one another as buyers of tires. Because each of them accounts for a large share of the tire market, each has some monopsony power in that market. General Motors, the largest, might be able to exert considerable monopsony power when contracting for supplies of tires (and other automotive parts).

In a competitive market, price and marginal value are equal. A buyer with mon- opsony power, however, can purchase a good at a price below marginal value. The extent to which price is marked down below marginal value depends on the elastic-ity of supply facing the buyer.16 If supply is very elastic (E is large), the markdown will be small and the buyer will have little monopsony power. Conversely, if sup-ply is very inelastic, the markdown will be large and the buyer will have consider-able monopsony power. Figures 10.16(a) and 10.16(b) illustrate these two cases.

1. Sources of Monopsony Power

What determines the degree of monopsony power in a market? Again, we can draw analogies with monopoly and monopoly power. We saw that monopoly power depends on three things: the elasticity of market demand, the number of sellers in the market, and the way those sellers interact. Monopsony power depends on three similar things: The elasticity of market supply, the number of buyers in the market, and the way those buyers interact.

ELASTICITY OF MARKET SUPPLY A monopsonist benefits because it faces an upward-sloping supply curve, so that marginal expenditure exceeds average expenditure. The less elastic the supply curve, the greater the difference between marginal expenditure and average expenditure and the more monopsony power the buyer enjoys. If only one buyer is in the market—a pure monopsonist—its monopsony power is completely determined by the elasticity of market supply. If supply is highly elastic, monopsony power is small and there is little gain in being the only buyer.

NUMBER OF BUYERS Most markets have more than one buyer, and the num- ber of buyers is an important determinant of monopsony power. When the number of buyers is very large, no single buyer can have much influence over price. Thus each buyer faces an extremely elastic supply curve, so that the mar- ket is almost completely competitive. The potential for monopsony power arises when the number of buyers is limited.

INTERACTION AMONG BUYERS Finally, suppose three or four buyers are in the market. If those buyers compete aggressively, they will bid up the price close to their marginal value of the product, and will thus have little monopsony power. On the other hand, if those buyers compete less aggressively, or even col- lude, prices will not be bid up very much, and the buyers’ degree of monopsony power might be nearly as high as if there were only one buyer.

So, as with monopoly power, there is no simple way to predict how much monopsony power buyers will have in a market. We can count the number of buyers, and we can often estimate the elasticity of supply, but that is not enough. Monopsony power also depends on the interaction among buyers, which can be more difficult to ascertain.

2. The Social Costs of Monopsony Power

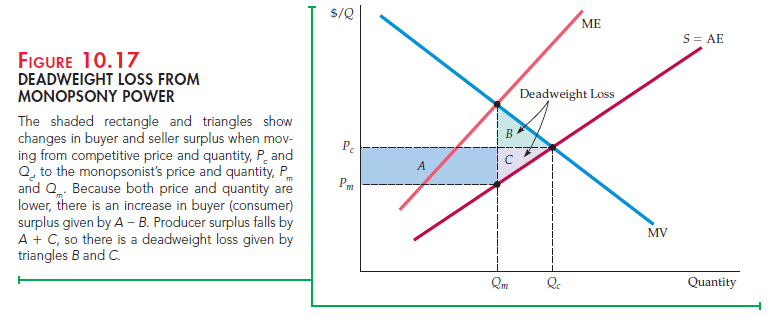

Because monopsony power results in lower prices and lower quantities pur- chased, we would expect it to make the buyer better off and sellers worse off. But suppose we value the welfare of buyers and sellers equally. How is aggre- gate welfare affected by monopsony power?

We can find out by comparing the buyer and seller surplus that results from a competitive market to the surplus that results when a monopsonist is the sole buyer. Figure 10.17 shows the average and marginal expenditure curves and marginal value curve for the monopsonist. The monopsonist’s net benefit is maximized by purchasing a quantity Qm at a price Pm such that marginal value equals marginal expenditure. In a competitive market, price equals marginal

value. Thus the competitive price and quantity, Pc and Qc, are found where the average expenditure and marginal value curves intersect. Now let’s see how surplus changes if we move from the competitive price and quantity, Pc and Qc, to the monopsony price and quantity, Pm and Qm.

With monopsony, the price is lower and less is sold. Because of the lower price, sellers lose an amount of surplus given by rectangle A. In addition, sell-ers lose the surplus given by triangle C because of the reduced sales. The total loss of producer (seller) surplus is therefore A + C. By buying at a lower price, the buyer gains the surplus given by rectangle A. However, the buyer buys less, Qm instead of Qc, and so loses the surplus given by triangle B. The total gain in surplus to the buyer is therefore A − B. Altogether, there is a net loss of surplus given by B + C. This is the deadweight loss from monopsony power. Even if the monopsonist’s gains were taxed away and redistributed to the producers, there would be an inefficiency because output would be lower than under competi-tion. The deadweight loss is the social cost of this inefficiency.

3. Bilateral Monopoly

What happens when a monopolist meets a monopsonist? It’s hard to say. We call a market with only one seller and only one buyer a bilateral monopoly. If you think about such a market, you’ll see why it is difficult to predict the price and quantity. Both the buyer and the seller are in a bargaining situation. Unfortunately, no simple rule determines which, if either, will get the better part of the bargain. One party might have more time and patience, or might be able to convince the other party that it will walk away if the price is too low or too high.

Bilateral monopoly is rare. Markets in which a few producers have some monopoly power and sell to a few buyers who have some monopsony power are more common. Although bargaining may still be involved, we can apply a rough principle here: Monopsony power and monopoly power will tend to counteract each other. In other words, the monopsony power of buyers will reduce the effec- tive monopoly power of sellers, and vice versa. This tendency does not mean that the market will end up looking perfectly competitive; if, for example, monop- oly power is large and monopsony power small, the residual monopoly power would still be significant. But in general, monopsony power will push price closer to marginal cost, and monopoly power will push price closer to marginal value.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

I have discovered great articles here. I love the way

you define. So ideal!

This piece of writing gives clear idea in support of the new visitors of blogging, that actually how to do running

a blog.

I have recently started a web site, the info you provide on this website has helped me greatly. Thank you for all of your time & work.