Anything to do with money is a matter of difficult choices. The savings and investment part also demands a line of careful decisions. First comes the grading of safety and access to spare cash. There is the current account for everyday expenses, followed by the amounts accumulating for predictable larger spending such as holidays, redecorating the home, replacing the car, the children’s education, and so on. Then comes the provisions for a safe old age, life assurance, pension and rainy-day reserves. Only when these necessities have been taken care of comes the riskier area of stock market investment. It is not cash you will need to realize at short notice but will supplement income for your old age, say.

Stock market investment is for cash you can spare in the sense that if its value falls it may be disappointing and inconvenient but will not cause serious hardship. It is also for people whose nerves can stand uncertainty – for people who will not lie awake at night fretting about the fluctuations of share prices or get ulcers if the business invested in goes off the boil, or even down the pan. If you can think of it in the sense of an alternative to a flutter on the 3.30 at Sandown, or a punt at a roulette wheel, and can accept reverses with a reasonably philosophical shrug, the stock market may be for you.

That is not quite a fair picture, since if the horse you back fails to win, all your stake is gone. Money in shares has a pretty fair chance of not vanishing completely as most companies stay afloat and continue to pay dividends to provide some return on the investment. In any case, unless you were being forced to sell, a drop in share price is only a notional loss while dividends continue to arrive. On top of that, not only are the odds way ahead of other forms of gambling, but the return is better than other forms of investment. Careful research, monitoring and evaluation can reduce risks on the stock market. If the hazards could cause alarm, it does not mean the stock market is closed to you. You can still benefit from the long-term performance of shares by the reduced-risk route of pooled investment vehicles (see Chapter 3). The money is still invested in shares but the dangers of big losses are lessened by spreading the risk.

But that does not end the decision making – on the contrary, it just starts it on a new tack. To sift the right investment from the many thousands available through stock exchanges takes a series of tests and decisions. There are risk/reward calculations and approaches to decide – other people can help by spelling out the options but not take the decisions for you. For instance, some people are prepared to bet at odds of 14.5 million to one against them, which would normally seem insane, but because the cost of taking part in the National Lottery is only £2 and the winnings can run into millions, lots of people are prepared to take a punt.

That shows some of the criteria for decisions. One way of screening the thousands of potential investments is to set your own goals clearly and explicitly. It is not nearly enough to say the aim is to make money out of the stock exchange. The process involves:

- Deciding the acceptable amount of risk. Compared with the return on a safe home for the cash like gilt-edged securities or a deposit account at a building society, is the profit from shares enough to compensate for the risks? How much risk am I prepared to accept, first in general, for investing in shares at all, then in the particular sort of shares to go for – such as accepting that small and new companies are more in danger of failing but do have the potential for a larger percentage growth in both share price and dividend; some companies are seasonal or more reactive to economic fluctuations; overseas shares include an element of currency risk?

- Setting a time horizon for the investment. Whether the investment is to be short, medium or long term: volatility of share price can be disregarded for the long-term investment and so the shorter-term investments would be more stable businesses.

- Choosing if it is to generate an income or capital growth. The former would send you to companies with a higher yield (the dividend as a percentage of the cash invested in the shares), the latter for companies with lower dividends but the potential for higher corporate growth.

- A host of subsidiary decisions, possibly including ethical considerations, territorial preferences, etc. Some people might be averse to tobacco, arms manufacturers, contraception, dealing with dictators, alcohol, inadequate ecological performance, poor labour relations and so on.

That process should help narrow the field slightly.

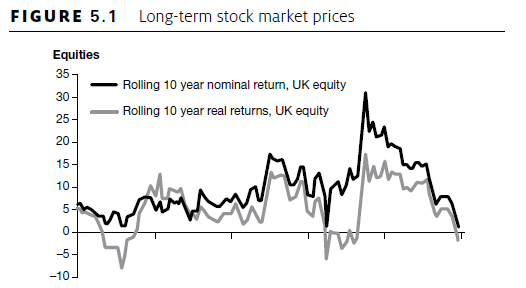

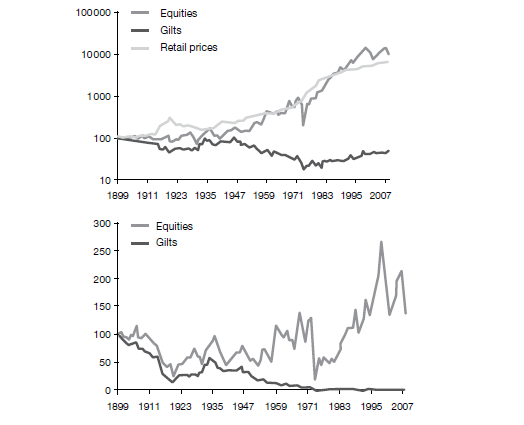

Another criterion might be the sort of reward you would need for the admitted risks of investing in shares. Both sides of that equation are subjective – risks vary with the timescale, the choice of investments and the range of holdings; rewards need to be compared with the return from alternative uses of the money such as putting the cash on deposit, into gilts, or into other investments such as property, art and so on. Returns on equities (another term for shares) are usually several percentage points higher than on gilts, which in turn are several points above deposit accounts, but what the real return will be in the future is only an extrapolation – history shows that both absolute and relative values change.

Even that is not the end of it, because there is no reason to insist that the whole investment pot is governed by a single strategy. Or, to put it another way, the effect of even a strong initial strategy can change as the amount and range of the investments grows. The first forays into the stock market might be guided by a low-risk long-term income demand. But as the portfolio extends, people are sometimes prepared to say that, the safe basis having been set, it is fair to try for a higher return by taking on a riskier investment. In addition, as they get more experienced and knowledgeable, some people are tempted to try a little more active trading to benefit from shorter-term fluctuations in particular companies or sectors.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Absolutely composed written content, thanks for entropy.