Retail inventory accounting systems can be complex because they entail a great deal of data (due to the number of items sold). A typical retailer’s dollar control system must provide such data as the sales and purchases made by that firm during a budget period, the value of beginning and ending inventory, markups and markdowns, and merchandise shortages.

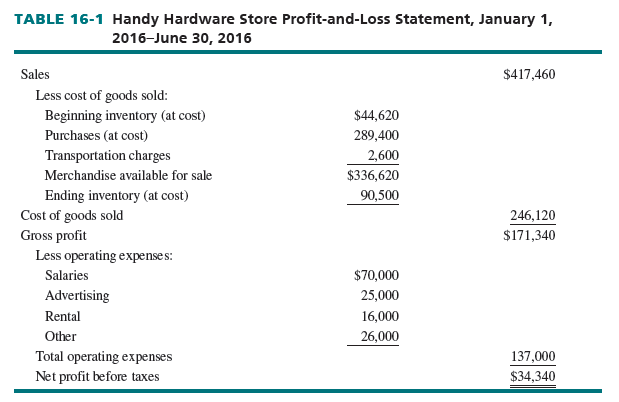

Table 16-1 shows a profit-and-loss statement for Handy Hardware Store for January 1, 2016, through June 30, 2016. The sales amount is total receipts over this time. Beginning inventory was computed by counting merchandise in stock on January 1, 2016—recorded at cost. Purchases (at cost) and transportation charges (costs incurred in shipping items from suppliers to the retailer) were derived by adding invoice slips for all merchandise bought by Handy in the period.

Together, beginning inventory, purchases, and transportation charges equal the cost of merchandise available for sale. The cost of goods sold equals the cost of merchandise available for sale minus the cost value of ending inventory. Sales less cost of goods sold yields gross profit, and net profit is gross profit minus retail operating expenses. Because Handy does a physical inventory twice yearly, ending inventory was figured by counting the items in stock on June 30, 2016—recorded at cost (Handy codes each item).

Retailers have data needs that are different from those of manufacturers. Assortments are larger. Costs cannot be printed on cartons unless coded (due to customer inspection). Stock shortages are higher. Sales are more frequent. Retailers require monthly, not quarterly, profit data.

Two inventory accounting systems are available: (1) The cost accounting system values merchandise at cost plus inbound transportation charges. (2) The retail accounting system values merchandise at current retail prices. Let’s study both methods in terms of the frequency with which data are obtained, the difficulties of a physical inventory and record keeping, the ease of settling insurance claims (if there is inventory damage), the extent to which shortages can be computed, and system complexities.

At our blog site (www.bermanevansretail.com), there are posts related to retail accounting and inventory valuation.

1. The Cost Method

With the cost method of accounting, the cost to the retailer of each item is recorded on an accounting sheet and/or is coded on a price tag or merchandise container. As a physical inventory is done, item costs must be learned, the quantity of every item in stock counted, and total inventory value at cost calculated. One way to code merchandise cost is to use a 10-letter equivalency system, such as M = 0, N = 1, O = 2, P = 3, Q = 4, R = 5, S = 6, T = 7, U = 8, and V = 9. An item coded with STOP has a cost value of $67.23. This technique is useful as an accounting tool and for retailers that allow price bargaining by customers (profit per item is easy to compute).

A retailer can use the cost method as it does physical or book inventories. A physical inventory means an actual merchandise count; a book inventory relies on record keeping.

A PHYSICAL INVENTORY SYSTEM USING THE COST METHOD In a physical inventory system, ending inventory—recorded at cost—is measured by counting the merchandise in stock at the close of a selling period. Gross profit is not computed until ending inventory is valued. A retailer using the cost method along with a physical inventory system derives gross profit only as often as it performs a full merchandise count. Because most firms do so just once or twice yearly, a physical inventory system alone imposes limits on planning. In addition, a firm might be unable to compute inventory shortages (due to pilferage and unrecorded breakage) because ending inventory value is set by adding the costs of all items in stock. It does not compute what the ending inventory should be.

A BOOK INVENTORY SYSTEM USING THE COST METHOD A book (perpetual) inventory system avoids the problem of infrequent financial analysis by keeping a running total of the value of all inventory on hand at cost at a given time. End-of-month inventory values can be computed without a physical inventory, and frequent financial statements can be prepared. In addition, a book inventory lets a retailer uncover stock shortages by comparing projected inventory values with actual inventory values through a physical inventory.2

A book inventory is kept by regularly recording purchases and adding them to existing inventory value; sales are subtracted to arrive at the new current inventory value (all at cost). Table 16-2 shows Handy Hardware’s book inventory system for July 1, 2016, through December 31, 2016; the beginning inventory in Table 16-2 is the ending inventory from Table 16-1. Table 16-2 assumes that merchandise costs are rather constant and monthly sales at cost are easy to compute. Yet, suppose merchandise costs rise. How would inventory value then be computed?

FIFO and LIFO are two ways to value inventory. The FIFO (first-in-first-out) method logically assumes old merchandise is sold first, while newer items remain in inventory. The LIFO (last-in-first-out) method assumes new merchandise is sold first, while older stock remains in inventory. FIFO matches inventory value with the current cost structure—the goods in inventory are the ones bought most recently, whereas LIFO matches current sales with the current cost structure—the goods sold first are the ones bought most recently. When inventory values rise, LIFO offers retailers a tax advantage because lower profits are shown.

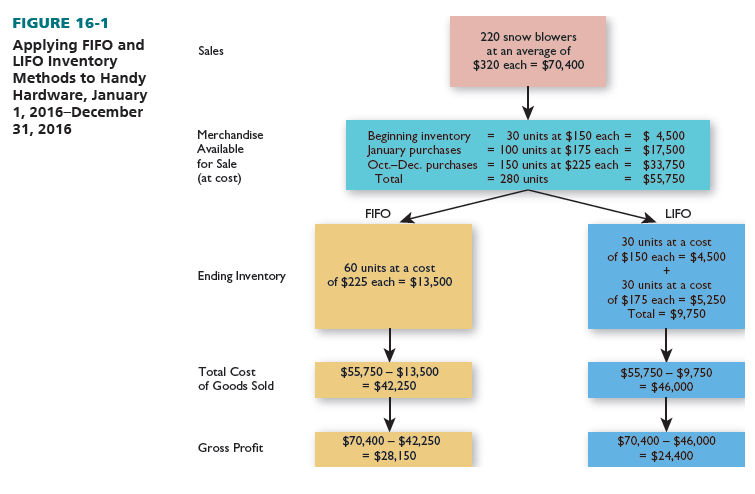

In Figure 16-1, the FIFO and LIFO methods are illustrated for Handy Hardware’s snow blowers for 2016; the store carries only one model of snow blower. Handy knows that it sold 220 snow blowers in 2016 at an average price of $320. It began 2016 with an inventory of 30 snow blowers, purchased for $150 each. During January 2016, it bought 100 snow blowers at $175 each; from October to December 2016, Handy bought another 150 snow blowers for $225 apiece. Because Handy sold 220 snow blowers in 2016, as of the close of business on December 31, it had 60 units remaining.

With the FIFO method, Handy assumes its beginning inventory and initial purchases were sold first. The 60 snow blowers remaining in inventory would have a cost value of $225 each, a total cost of goods sold of $42,250, and a gross profit of $28,150. With the LIFO method, Handy assumes the most recently purchased items were sold first and the remaining inventory would consist of beginning goods and early purchases. Of the snow blowers remaining in inventory, 30 would have a cost value of $150 each and 30 a cost value of $175 apiece, resulting in a total cost of goods sold of $46,000 and a gross profit of $24,400. The FIFO method presents a more accurate picture of the cost of goods sold and the true cost value of ending inventory. The LIFO method indicates a lower profit, leading to the payment of lower taxes but an understated ending inventory value at cost.

The retail method of inventory, which combines FIFO and LIFO concepts, is explained shortly.

DISADVANTAGES OF COST-BASED INVENTORY SYSTEMS Cost-based physical and book systems have significant disadvantages. First, both require that a cost be assigned to each item in stock (and to each item sold). When merchandise costs change, cost-based valuation systems work best for firms with low inventory turnover, limited assortments, and high average prices—such as car dealers.

Second, neither cost-based method adjusts inventory values to reflect style changes, end-of- season markdowns, or sudden surges of demand (which may raise prices). Thus, ending inventory value based on merchandise cost may not reflect its actual worth. This discrepancy could be troublesome if inventory value is used in filing insurance claims for losses.

Despite these factors, retailers that make the products they sell—such as bakeries, restaurants, and furniture showrooms—often keep records on a cost basis. A department store with these operations can use the cost method for them and the retail method for other areas.

2. The Retail Method

With the retail method of accounting, closing inventory value is determined by calculating the average relationship between the cost and retail values of merchandise available for sale during a period. Although the retail method overcomes the disadvantages of the cost method, it requires detailed records and is more complex because ending inventory is first valued in retail dollars and then converted to compute gross margin (gross profit).

The three basic steps to determine ending inventory value by the retail method are:

- Calculating the cost complement

- Calculating deductions from retail value

- Converting retail inventory value to cost

CALCULATING THE COST COMPLEMENT The value of beginning inventory, net purchases, additional markups, and transportation charges are all included in the retail method. Beginning inventory and net purchase amounts (purchases less returns) are recorded at both cost and retail levels. Additional markups represent the extra revenues received when a retailer increases selling prices, due to inflation or unexpectedly high demand. Transportation charges are the retailer’s costs for shipping the goods it buys from suppliers to the retailer. Table 16-3 shows the total merchandise available for sale at cost and at retail for Handy Hardware from July 1, 2016, through December 31, 2016, using the costs in Table 16-2.

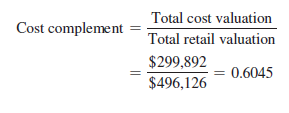

By using Table 16-3 data, the average relationship of cost to retail value for all merchandise available for sale by Handy Hardware—the cost complement—can be computed:

Because the cost complement is 0.6045 (60.45 percent), on average, 60.45 cents of every retail sales dollar went to cover Handy Hardware’s merchandise cost.

CALCULATING DEDUCTIONS FROM RETAIL VALUE The ending retail value of inventory must reflect all deductions from the total merchandise available for sale at retail. Besides sales, deductions include markdowns (for special sales and end-of-season goods), employee discounts, and stock shortages (due to pilferage and unrecorded breakage). Although sales, markdowns, and employee discounts can be recorded throughout an accounting period, a physical inventory is needed to learn about stock shortages.

From Table 16-3, it is known that Handy Hardware had a retail value of merchandise available for sale of $496,126 for the period from July 1, 2016, through December 31, 2016. As shown in Table 16-4, this was reduced by sales of $422,540 and recorded markdowns and employee discounts of $14,034. The ending book value of inventory at retail as of December 31, 2016, was $59,552.

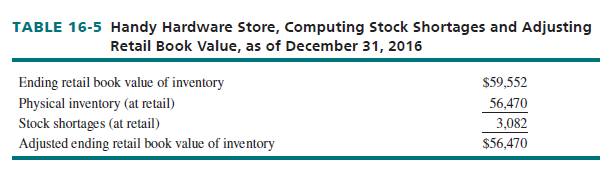

To compute stock shortages, the retail book value of ending inventory is compared with the actual physical ending inventory at retail. If book inventory exceeds physical inventory, a shortage exists. Table 16-5 shows the results of Handy’s physical inventory. Shortages were $3,082 (at retail), and book value was adjusted accordingly. Although Handy knows the shortages were from pilferage, bookkeeping errors, and overshipments not billed to customers, it cannot learn the proportion of shortages from each factor.

Occasionally, a physical inventory may reveal a stock overage—an excess of physical inventory value over book value. This may be due to errors in a physical inventory or in keeping a book inventory. If overages occur, ending retail book value is adjusted upward. Inasmuch as a retailer has to conduct a physical inventory to compute shortages (overages), and a physical inventory is usually taken only once or twice a year, shortages (overages) are often estimated for monthly merchandise budgets.

CONVERTING RETAIL INVENTORY VALUE TO COST The retailer must next convert the adjusted ending retail book value of inventory to cost so as to compute dollar gross profit (gross margin). The ending inventory at cost equals the adjusted ending retail book value multiplied by the cost complement. For Handy Hardware, this was:

Ending inventory (at cost) = Adjusted ending retail book value X Cost complement

= $56,470 X 0.6045 = $34,136

This computation does not yield the exact inventory cost. It shows the average relationship between cost and the retail selling price for all merchandise available for sale.

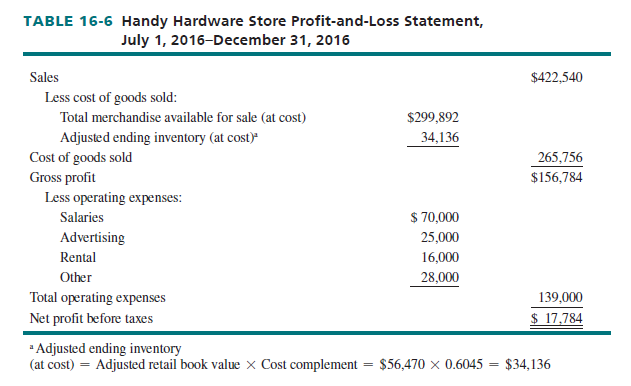

The adjusted ending inventory at cost can be used to find gross profit. As Table 16-6 shows, Handy’s 6-month cost of goods sold was $265,756, resulting in gross profit of $156,784. By deducting operating expenses of $139,000, Handy learns that the net profit before taxes for this period was $17,784.

ADVANTAGES OF THE RETAIL METHOD Compared with other techniques, there are several advantages to the retail method of accounting:

- Valuation errors are reduced when conducting a physical inventory because merchandise value is recorded at retail and costs do not have to be decoded.

- Because the process is simpler, a physical inventory can be completed more often. This lets a firm be more aware of slow-moving items and stock shortages.

- The physical inventory method at cost requires a physical inventory to prepare a profit-and- loss statement. The retail method lets a firm set up a profit-and-loss statement based on book inventory. The retailer can then estimate the stock shortages between physical inventories and study departmental profit trends.

- A complete record of ending book values helps determine insurance coverage and settle insurance claims. The retail book method gives an estimate of inventory value throughout the year. Because physical inventories are usually taken when merchandise levels are low, the book value at retail lets retailers plan insurance coverage for peak periods and shows the values of goods on hand. The retail method is accepted in insurance claims.

LIMITATIONS OF THE RETAIL METHOD The greatest weakness is the bookkeeping burden of recording data. Ending book inventory figures can be correctly computed only if the following are accurately noted: the value of beginning inventory (at cost and at retail), purchases (at cost and at retail), shipping charges, markups and markdowns, employee discounts, transfers from other departments or stores, returns, and sales. Although personnel are freed from taking many physical inventories, ending book value at retail may be inaccurate unless all required data are precisely recorded. With computerization, this potential problem is lessened.

Another limitation is that the cost complement is an average based on the total cost of merchandise available for sale and total retail value. The ending cost value only approximates the true inventory value. This may cause misinformation if fast-selling items have different markups from slow-selling items or if there are wide variations among the markups of different goods.

Familiarity with the retail and cost methods of inventory is essential for understanding the financial merchandise management material described in the balance of this chapter.

Source: Barry Berman, Joel R Evans, Patrali Chatterjee (2017), Retail Management: A Strategic Approach, Pearson; 13th edition.

Good info. Lucky me I reach on your website by accident, I bookmarked it.