To evaluate a market outcome, we often ask whether it achieves economic efficiency—the maximization of aggregate consumer and producer surplus. We just saw how price controls create a deadweight loss. The policy therefore imposes an efficiency cost on the economy: Taken together, producer and con- sumer surplus are reduced by the amount of the deadweight loss. (Of course, this does not mean that such a policy is bad; it may achieve other objectives that policymakers and the public deem important.)

MARKET FAILURE One might think that if the only objective is to achieve economic efficiency, a competitive market is better left alone. This is sometimes, but not always, the case. In some situations, a market failure occurs: Because prices fail to provide the proper signals to consumers and producers, the unregulated competitive market is inefficient—i.e., does not maximize aggre- gate consumer and producer surplus. There are two important instances in which market failure can occur:

- Externalities: Sometimes the actions of either consumers or producers result in costs or benefits that do not show up as part of the market price. Such costs or benefits are called externalities because they are “external” to the market. One example is the cost to society of environmental pollu- tion by a producer of industrial chemicals. Without government interven- tion, such a producer will have no incentive to consider the social cost of pollution. We examine externalities and the proper government response to them in Chapter 18.

- Lack of Information: Market failure can also occur when consumers lack information about the quality or nature of a product and so cannot make utility-maximizing purchasing decisions. Government intervention (e.g., requiring “truth in labeling”) may then be desirable. The role of informa- tion is discussed in detail in Chapter 17.

In the absence of externalities or a lack of information, an unregulated com- petitive market does lead to the economically efficient output level. To see this, let’s consider what happens if price is constrained to be something other than the equilibrium market-clearing price.

We have already examined the effects of a price ceiling (a price held below the market-clearing price). As you can see in Figure 9.2 (page 320), produc- tion falls (from Q0 to Q1), and there is a corresponding loss of total surplus (the deadweight-loss triangles B and C). Too little is produced, and consumers and producers in the aggregate are worse off.

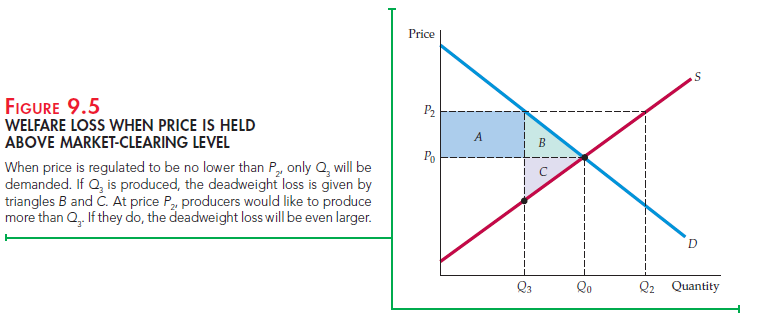

Now suppose instead that the government required the price to be above the market-clearing price—say, P2 instead of P0. As Figure 9.5 shows, although producers would like to produce more at this higher price (Q2 instead of Q0), consumers will now buy less (Q3 instead of Q0). If we assume that producers produce only what can be sold, the market output level will be Q3, and again, there is a net loss of total surplus. In Figure 9.5, rectangle A now represents a transfer from consumers to producers (who now receive a higher price), but triangles B and C again represent a deadweight loss. Because of the higher price, some consumers are no longer buying the good (a loss of consumer surplus given by triangle B), and some producers are no longer producing it (a loss of producer surplus given by triangle C).

In fact, the deadweight loss triangles B and C in Figure 9.5 give an optimistic assessment of the efficiency cost of policies that force price above market-clearing levels. Some producers, enticed by the high price P2, might increase their capacity and output levels, which would result in unsold output. (This happened in the airline industry when, prior to 1980, fares were regulated above market-clearing levels by the Civil Aeronautics Board.) Or to satisfy producers, the government

might buy up unsold output to maintain production at Q2 or close to it. (This is what happens in U.S. agriculture.) In both cases, the total welfare loss will exceed the areas of triangles B and C.

We will examine minimum prices, price supports, and related policies in some detail in the next few sections. Besides showing how supply–demand analysis can be used to understand and assess these policies, we will see how deviations from the competitive market equilibrium lead to efficiency costs.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

Whats Going down i’m new to this, I stumbled upon this I have found It positively helpful and it has aided me out loads. I am hoping to contribute & aid other users like its helped me. Great job.