A merchandising business should keep enough inventory on hand to meet its customers’ needs. A failure to do so may result in lost sales. However, too much inventory ties up funds that could be used to improve operations. Also, excess inventory increases expenses such as storage and property taxes. Finally, excess inventory increases the risk of losses due to price declines, damage, or changes in customer tastes.

Two measures to analyze the efficiency and effectiveness of inventory management are:

- inventory turnover and

- number of days’ sales in inventory.

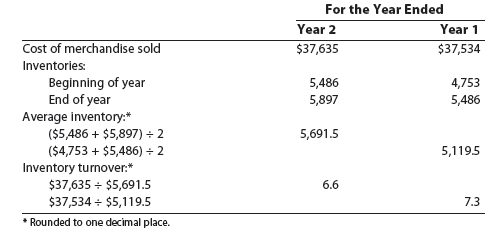

Inventory turnover measures the relationship between the cost of merchandise sold and the amount of inventory carried during the period. It is computed as follows:

![]()

To illustrate, inventory turnover for Best Buy is computed from the following data (in millions) taken from two recent annual reports.

Generally, the larger the inventory turnover the more efficient and effective the company is in managing inventory. As shown above, inventory turnover decreased from 7.3 to 6.6 during Year 2, and thus Best Buy’s inventory efficiency decreased during Year 2.

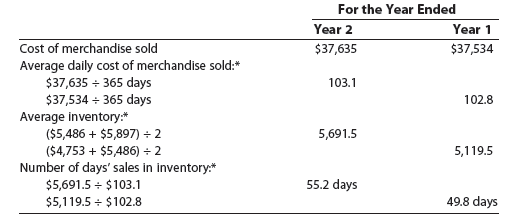

The number of days’ sales in inventory measures the length of time it takes to acquire, sell, and replace the inventory. It is computed as follows:

![]()

The average daily cost of merchandise sold is determined by dividing the cost of merchandise sold by 365. Based upon the preceding data, the number of days’ sales in inventory for Best Buy is computed below.

Generally, the lower the number of days’ sales in inventory, the more efficient and effective the company is in managing inventory. As shown previously, the number of days’ sales in inventory increased from 49.8 to 55.2 during Year 2, and thus Best Buy’s inventory management did not improve. This is consistent with the decrease in inventory during the year.

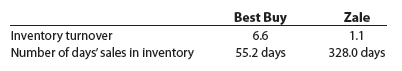

As with most financial ratios, differences exist among industries. To illustrate, Zale Corporation is a large retailer of fine jewelry in the United States. Since jewelry doesn’t sell as rapidly as Best Buy’s consumer electronics, Zale’s inventory turnover and number of days’ sales in inventory should be significantly different than Best Buy’s. For a recent year, this is confirmed as shown below.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Wonderful article! We are linking to this particularly great post on our

website. Keep up the good writing.