When companies borrow money, they promise to make regular interest payments and to repay the principal. However, this liability is limited. Stockholders have the right to default on the debt if they are willing to hand over the corporation’s assets to the lenders. Clearly, they will choose to do this only if the value of the assets is less than the amount of the debt.14

Debt has first claim on cash flows, but its claim is limited. Therefore, in contrast to equity, it does not have residual cash-flow rights and does not participate in the upsides of the business. Also, unlike equity, debt offers no control rights unless the firm defaults or violates debt covenants. Because lenders are not considered to be owners of the firm, they do not normally have any voting power.

The company’s payments of interest are regarded as a cost and are deducted from taxable income. Thus interest is paid from before-tax income, whereas dividends on common and preferred stock are paid from after-tax income. Therefore, the government provides a tax subsidy for debt that it does not provide for equity (and from time to time complains that companies borrow too much). We discuss debt and taxes in detail in Chapter 18.

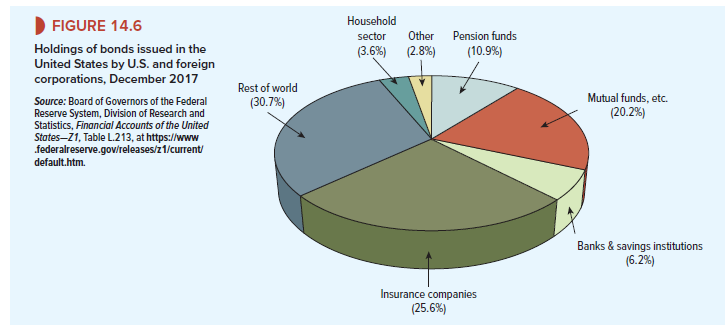

We have seen that financial intermediaries own the majority of corporate equity. Figure 14.6 shows that this is also true of the company’s bonds. In this case, it is the insurance companies that own the largest stake.15

1. Debt Comes in Many Forms

The financial manager is faced with an almost bewildering choice of debt securities. In Chapter 24, we look in some detail at the different types of corporate debt. For the moment, simply notice that the mixture of debt securities that each company issues reflects the financial manager’s response to a number of questions:

- Should the company borrow short-term or long-term? If your company simply needs to finance a temporary increase in inventories ahead of the holiday season, then it may make sense to take out a short-term bank loan. But suppose that the cash is needed to pay for expansion of an oil refinery. Refinery facilities can operate more or less continuously for 15 or 20 years. In that case, it would be more appropriate to issue a long-term bond.16

Some loans are repaid in a steady, regular way; in other cases, the entire loan is repaid at maturity. Occasionally the borrower has the option to terminate the loan early.

- Should the debt be fixed or floating rate? The interest payment, or coupon, on longterm bonds is commonly fixed at the time of issue. If a $1,000 bond is issued when long-term interest rates are 10%, the firm continues to pay $100 per year regardless of how interest rates fluctuate.

Most bank loans and some bonds offer a variable, or floating, rate. For example, the interest rate in each period may be set at 1% above LIBOR (London Interbank Offered Rate), which is the interest rate at which major international banks lend dollars to each other. When LIBOR changes, the interest rate on the loan also changes.

- Should you borrow dollars or some other currency? Many firms in the United States borrow abroad. Often they may borrow dollars abroad (foreign investors have large holdings of dollars), but firms with overseas operations may decide to issue debt in a foreign currency. After all, if you need to spend foreign currency, it probably makes sense to borrow foreign currency.

International bonds have usually been marketed by the London branches of international banks, and have traditionally been known as eurobonds. A eurobond may be denominated in dollars, yen, or any other currency. Unfortunately, when the single European currency was established, it was called the euro. It is, therefore, easy to confuse a eurobond (a bond that is sold internationally) with a bond that is denominated in euros.

- What promises should you make to the lender? Lenders want to make sure that their debt is as safe as possible. Therefore, they may demand that their debt is senior to other debt. If default occurs, senior debt is first in line to be repaid. The junior, or subordinated, debtholders are paid only after all senior debtholders are satisfied (though all debtholders rank ahead of the preferred and common stockholders).

The firm may also set aside some of its assets specifically for the protection of particular creditors. Such debt is said to be secured, and the assets that are set aside are known as collateral. Thus, a retailer might offer inventory or accounts receivable as collateral for a bank loan. If the retailer defaults on the loan, the bank can seize the collateral and use it to help pay off the debt.

Usually, the firm also provides assurances to the lender that it will not take unreasonable risks. For example, a firm that borrows in moderation is less likely to get into difficulties than one that is up to its gunwales in debt. So the borrower may agree to limit the amount of extra debt that it can issue. Lenders are also concerned that, if trouble occurs, others will push ahead of them in the queue. Therefore, the firm may agree not to create new debt that is senior to existing debtholders or to put aside assets for other lenders.

- Should you issue straight or convertible bonds? Companies often issue securities that give the owner an option to convert them into other securities. These options may have [1] [2] a substantial effect on value. The most dramatic example is provided by a warrant, which is nothing but an option. The owner of a warrant can purchase a set number of the company’s shares at a set price before a set date. Warrants and bonds are often sold together as a package.

A convertible bond gives its owner the option to exchange the bond for a predetermined number of shares. The convertible bondholder hopes that the issuing company’s share price will zoom up so that the bond can be converted at a big profit. But if the shares zoom down, there is no obligation to convert; the bondholder remains a bondholder.

2. A Debt by Any Other Name

The word debt sounds straightforward, but companies make a number of promises that look suspiciously like debt but are treated differently in the accounts. Some of these disguised debts are easily spotted. For example, accounts payable are simply obligations to pay for goods that have already been delivered and are, therefore, like short-term debt.

Other arrangements are less obvious. For example, instead of borrowing to buy new equipment, the company may rent or lease it on a long-term basis. In this case, the firm promises to make a series of lease payments to the owner of the equipment. This is just like the obligation to make payments on an outstanding loan. If the firm gets into deep water, it can’t choose to miss out on its debt interest, and it can’t choose to skip those lease payments.

Here is another example of a disguised debt. When American Airlines filed for bankruptcy in 2011, it had promised its employees pensions valued at $18.5 billion. This obligation was, in effect, a senior debt because American was obligated to make payments to retired employees. Unfortunately, American had set aside only $8.3 billion to meet this obligation.

Pension obligations should be valued by discounting future payments at a debt interest rate. When interest rates change, the present value of pension obligations changes, too. For example, in May 2015, the German airline Lufthansa announced that the present value of its pension obligations increased from €7.2 billion to €10.2 billion in the first quarter of 2015, largely because of a decrease from 2.6% to 1.7% in the interest rate used for discounting.

There is nothing underhanded about lease or pension obligations. They are explained in the notes to a corporation’s financial statements when they do not appear explicitly on its balance sheet. Investors recognize the debt-equivalent obligations and the financial risks that they create.[3]

But now and then, a company works hard to ensure that investors do not know how much the company has borrowed. For example, Enron was able to borrow $658 million by setting up special-purpose entities (SPEs), which raised cash by a mixture of equity and debt and then used these debts to help fund the parent company. None of this debt showed up on Enron’s balance sheet, but the debt showed up with a vengeance in Enron’s death spiral toward bankruptcy in 2001.

3. Variety’s the Very Spice of Life

We have indicated several dimensions along which corporate securities can be classified. That gives the financial manager plenty of choice in designing securities. As long as you can convince investors of its attractions, you can issue a convertible, subordinated, floating-rate bond denominated in Swedish kronor. Rather than combining features of existing securities, you may create an entirely new one. We can imagine a coal mining company issuing convertible bonds on which the payment fluctuates with coal prices. We know of no such security, but it is perfectly legal to issue it—and who knows?—it might generate considerable interest among investors.

That completes our tour of corporate securities. You may feel like the tourist who has just seen 12 cathedrals in five days. But there will be plenty of time in later chapters for reflection and analysis. It is now time to move on and to look at the markets in which the firm’s securities are traded and at the financial intermediaries that hold them.

Do you have a spam problem on this site; I also am a blogger, and I was wanting to know your situation; we have created some nice methods and we are looking to trade methods with others, be sure to shoot me an email if interested.

There is evidently a lot to know about this. I think you made certain good points in features also.