Our next task is to develop a short-term financial plan that covers the forecasted requirements in the most economical way. We move on to that topic after two general observations:

- The large cash outflows in the first two quarters do not necessarily spell trouble for Dynamic Mattress. In part, they reflect the capital investment made in the first quarter: Dynamic is spending $70 million, but it should be acquiring an asset worth that much or more. The cash outflows also reflect low sales in the first half of the year; sales recover in the second half.[1] If this is a predictable seasonal pattern, the firm should have no trouble borrowing to help it get through the slow months.

- Table 29.6 is only a best guess about future cash flows. It is a good idea to think about the uncertainty in your estimates. For example, you could undertake a sensitivity analysis, in which you inspect how Dynamic’s cash requirement would be affected by a shortfall in sales or by a delay in collections.

Dynamic’s cash budget defines its problem. Its financial manager must find short-term financing to cover the firm’s forecast cash requirements. There are dozens of sources of shortterm financing, but, for simplicity, we will assume that Dynamic has just two options:

- Bank loan. Dynamic has an existing arrangement with its bank, allowing it to borrow up to $100 million at an interest rate of 10% per year, or 2.5% per quarter. It can borrow and repay the loan whenever it chooses, but the company may not exceed its credit limit.

- Stretching payables. Dynamic can also raise capital by putting off payment of its bills. The financial manager believes that Dynamic can defer up to $100 million in each quarter. Thus, $100 million can be saved in the first quarter by not paying bills in that quarter. (Note that the cash-flow forecasts in Table 29.6 assumed that these bills will be paid in the first quarter.) If deferred, these payments must be made in the second quarter, but up to $100 million of the second quarter bills can be deferred to the third quarter, and so on.

Stretching payables is often costly, even if no ill will is incurred.[2] The reason is that suppliers may offer discounts for prompt payment. Dynamic loses this discount if it pays late. In this example, we assume the lost discount is 5% of the amount deferred. In other words, if a $100 payment is delayed, the firm must pay $105 in the next quarter. This is similar to borrowing at a quarterly interest rate of 5%, or equivalently at an annualized rate over 20% (more precisely, 1.054 – 1 = .216, or 21.6%).

1. Dynamic Mattress’s Financing Plan

With these two options, the short-term financing strategy is obvious. Use the bank loan first, if necessary up to the $100 million limit. If there is still a shortage of cash, stretch payables.

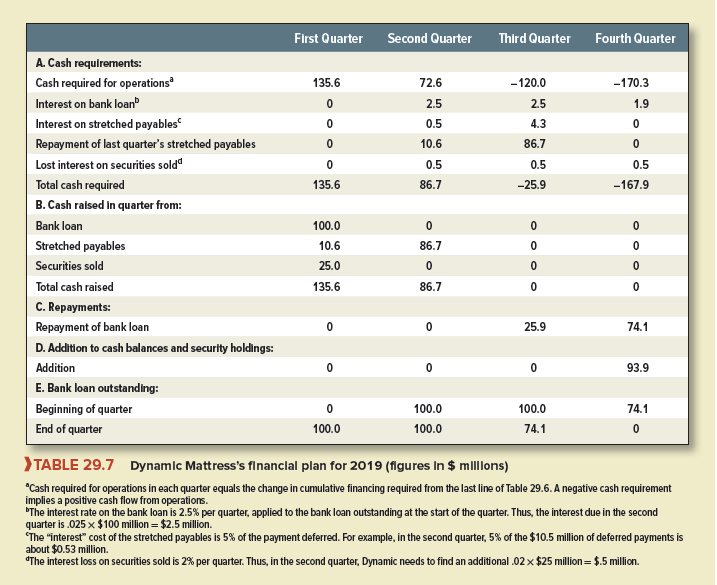

Table 29.7 shows the resulting plan. In the first quarter of 2019, the plan calls for borrowing the full amount from the bank ($100 million) and stretching $10.6 million of payables (see lines 1 and 2 of Panel B). In addition, the company sells the $25 million of marketable securities it held at the end of 2018. Thus, it raises $100 + $10.6 + $25 = $135.6 million of cash in the first quarter (see the last line of Panel B).

In the second quarter, Dynamic needs to raise an additional $72.6 million to support its operations. It also owes interest of $2.5 million on its bank loan. It must retire the payables that it stretched last quarter. With the 5% interest on that implicit loan from its suppliers, this adds $10.6 + $.5 million to the funds it must raise in the second quarter. Finally, to compensate for the interest it had been earning on the securities it sold in the first quarter, it will require another $.5 million. In total, therefore, it must come up with $86.7 million in the second quarter.

In the third quarter, the firm generates a $120 million cash-flow surplus from operations. Part of that surplus, $86.7 million, is used to pay off the stretched payables from the second quarter, as it is required to do. A small portion is used to pay interest on its outstanding loans. It uses the remaining cash-flow surplus, $25.9 million (last line of Panel A), to pay down its bank loan. In the fourth quarter, the firm has a surplus from operations of $170.3 million. It pays off the interest and remaining principal on the bank loan and is able to invest $93.9 million in cash and marketable securities.

2. Evaluating the Plan

Does the plan shown in Table 29.7 solve Dynamic’s short-term financing problem? No— the plan is feasible, but Dynamic can probably do better. The most glaring weakness is its reliance on stretching payables, an extremely expensive financing device. Remember that it costs Dynamic 5% per quarter to delay paying bills—an effective interest rate of greater than 20% per year.

The first plan would merely stimulate the financial manager to search for cheaper sources of short-term borrowing. The financial manager would ask several other questions as well. For example:

- Does Dynamic need a larger reserve of cash or marketable securities to guard against, say, its customers stretching their payables (thus slowing down collections on accounts receivable)?

- Does the plan yield satisfactory current and quick ratios?[3] Its bankers may be worried if these ratios deteriorate.

- Are there intangible costs to stretching payables? Will suppliers begin to doubt Dynamic’s creditworthiness?

- Does the plan for 2019 leave Dynamic in good financial shape for 2020? (Here the answer is yes because Dynamic will have paid off all short-term borrowing by the end of the year.)

- Should Dynamic try to arrange long-term financing for the major capital expenditure in the first quarter? This seems sensible, following the rule of thumb that long-term assets deserve long-term financing. It would also dramatically reduce the need for short-term borrowing. A counterargument is that Dynamic is financing the capital investment only temporarily by short-term borrowing. By year-end, the investment is paid for by cash from operations. Thus, Dynamic’s initial decision not to seek immediate long-term financing may reflect a preference for ultimately financing the investment with retained earnings.

- Perhaps the firm’s operating and investment plans can be adjusted to make the short-term financing problem easier. Is there any easy way of deferring the first quarter’s large cash outflow? For example, suppose that the large capital investment in the first quarter is for new mattress-stuffing machines to be delivered and installed in the first half of the year. The new machines are not scheduled to be ready for full-scale use until August. Perhaps the machine manufacturer could be persuaded to accept 60% of the purchase price on delivery and 40% when the machines are installed and operating satisfactorily.

- Should Dynamic release cash by reducing the level of other current assets? For example, it could reduce receivables by getting tough with customers who are late paying their bills. (The cost is that, in the future, these customers may take their business elsewhere.) Or it may be able to get by with lower inventories of mattresses. (The cost here is that it may lose business if there is a rush of orders that it cannot supply.)

Short-term financing plans must be developed by trial and error. You lay out one plan, think about it, and then try again with different assumptions on financing and investment alternatives. You continue until you can think of no further improvements. Trial and error is important because it helps you understand the real nature of the problem the firm faces. Here we can draw a useful analogy between the process of planning and Chapter 10’s discussion of project analysis. In Chapter 10, we described sensitivity analysis and other tools used by firms to find out what makes capital investment projects tick and what can go wrong with them. Dynamic’s financial manager faces the same kind of task here: not just to choose a plan but to understand what can go wrong and what will be done if conditions change unexpectedly.[4]

3. A Note on Short-Term Financial Planning Models

Working out a consistent short-term plan requires burdensome calculations. Fortunately, much of the arithmetic can be delegated to a computer. Many large firms have built short-term financial planning models to do this. Smaller companies do not face so much detail and complexity and often find it easier to work with a spreadsheet program on a personal computer. In either case, the financial manager specifies forecasted cash requirements or surpluses, interest rates, credit limits, etc., and the model grinds out a plan like the one shown in Table 29.7.

The computer also produces balance sheets, income statements, and any special reports the financial manager may require. Smaller firms that do not want custom-built models can rent general-purpose models offered by banks, accounting firms, management consultants, or specialized computer software firms.

Most of these models simply work out the consequences of the assumptions specified by the financial manager. Optimization models for short-term financial planning are also available. These models are usually linear-programming models. They search for the best plan from a range of alternative policies. These models help when the firm faces complex problems where trial and error might never identify the best combination of alternatives.

Of course, the best plan for one set of assumptions may prove disastrous if the assumptions are wrong. Thus the financial manager always needs to explore the implications of alternative assumptions about future cash flows, interest rates, and so on.

I’ll immediately grab your rss feed as I can’t find your email subscription link or newsletter service. Do you have any? Kindly let me know so that I could subscribe. Thanks.