When the periodic inventory system is used, only revenue is recorded each time a sale is made. No entry is made at the time of the sale to record the cost of the merchandise sold. At the end of the accounting period, a physical inventory is taken to determine the cost of the inventory and the cost of the merchandise sold.[1]

Like the perpetual inventory system, a cost flow assumption must be made when identical units are acquired at different unit costs during a period. In such cases, the FIFO, LIFO, or weighted average cost method is used.

1. First-In, First-Out Method

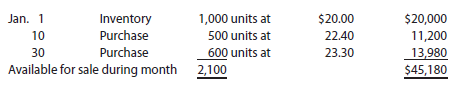

To illustrate the use of the FIFO method in a periodic inventory system, we use the same data for Item 127B as in the perpetual inventory example. The beginning inventory and purchases of Item 127B in January are as follows:

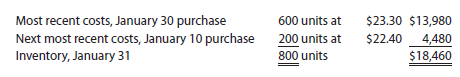

The physical count on January 31 shows that 800 units are on hand. Using the FIFO method, the cost of the merchandise on hand at the end of the period is made up of the most recent costs. The cost of the 800 units in the ending inventory on January 31 is determined as follows:

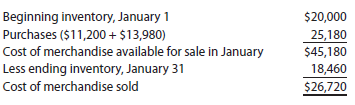

Deducting the cost of the January 31 inventory of $18,460 from the cost of merchandise available for sale of $45,180 yields the cost of merchandise sold of $26,720, as shown below.

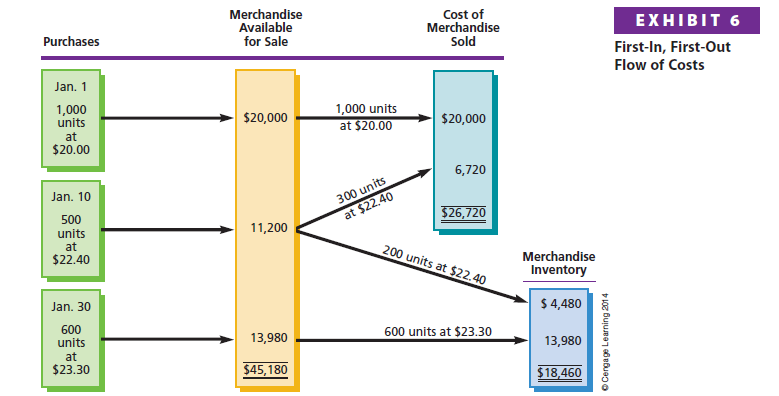

The $18,460 cost of the ending merchandise inventory on January 31 is made up of the most recent costs. The $26,720 cost of merchandise sold is made up of the beginning inventory and the earliest costs. Exhibit 6 shows the relationship of the cost of merchandise sold for January and the ending inventory on January 31.

2. Last-In, First-Out Method

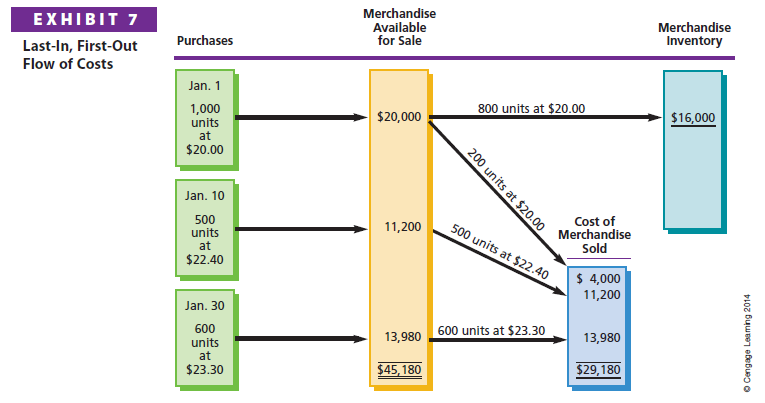

When the LIFO method is used, the cost of merchandise on hand at the end of the period is made up of the earliest costs. Based on the same data as in the FIFO example, the cost of the 800 units in ending inventory on January 31 is $16,000, which consists of 800 units from the beginning inventory at a cost of $20.00 per unit.

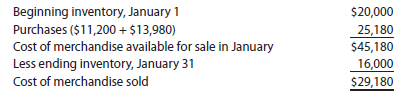

Deducting the cost of the January 31 inventory of $16,000 from the cost of merchandise available for sale of $45,180 yields the cost of merchandise sold of $29,180, as shown below.

The $16,000 cost of the ending merchandise inventory on January 31 is made up of the earliest costs. The $29,180 cost of merchandise sold is made up of the most recent costs. Exhibit 7 shows the relationship of the cost of merchandise sold for January and the ending inventory on January 31.

3. Weighted Average Cost Method

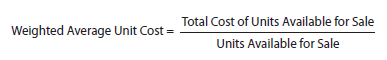

The weighted average cost method uses the weighted average unit cost for determining the cost of merchandise sold and the ending merchandise inventory. If purchases are relatively uniform during a period, the weighted average cost method provides results that are similar to the physical flow of goods.

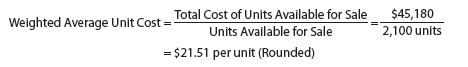

The weighted average unit cost is determined as follows:

To illustrate, the data for Item 127B is used as follows:

The cost of the January 31 ending inventory is as follows:

inventory, January 31: $17,208 (800 units x $21.51)

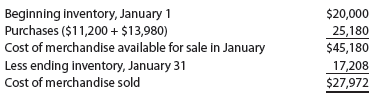

Deducting the cost of the January 31 inventory of $17,208 from the cost of merchandise available for sale of $45,180 yields the cost of merchandise sold of $27,972, as shown below.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I like the efforts you have put in this, regards for all the great articles.