Even if a systems project supports a firm’s strategic goals and meets user information requirements, it needs to be a good investment for the firm. The value of systems from a financial perspective essentially revolves around the issue of return on invested capital. Does a particular information system investment produce sufficient returns to justify its costs?

1. Information System Costs and Benefits

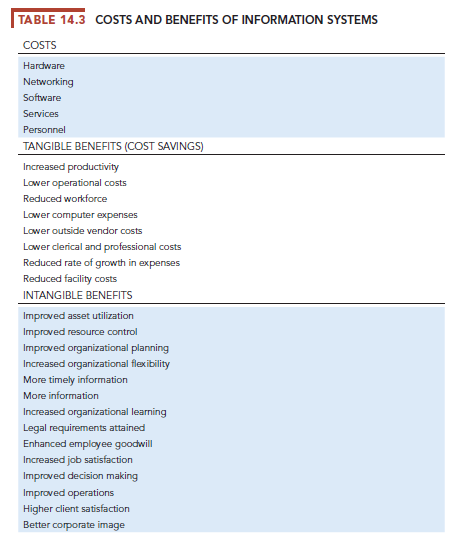

Table 14.3 lists some of the more common costs and benefits of systems. Tangible benefits can be quantified and assigned a monetary value. Intangible benefits, such as more efficient customer service or enhanced decision making, cannot be immediately quantified but may lead to quantifiable gains in the long run. Transaction and clerical systems that displace labor and save space always produce more measurable, tangible benefits than management information systems, decision-support systems, and computer-supported collaborative work systems (see Chapter 2 and Chapter 12).

Chapter 5 introduced the concept of total cost of ownership (TCO), which is designed to identify and measure the components of information technology expenditures beyond the initial cost of purchasing and installing hardware and software. However, TCO analysis provides only part of the information needed to evaluate an information technology investment because it does not typically deal with benefits, cost categories such as complexity costs, and “soft” and strategic factors discussed later in this section.

2. Capital Budgeting for Information Systems

To determine the benefits of a particular project, you’ll need to calculate all of its costs and all of its benefits. Obviously, a project where costs exceed benefits should be rejected. But even if the benefits outweigh the costs, additional financial analysis is required to determine whether the project represents a good return on the firm’s invested capital. Capital budgeting models are one of several techniques used to measure the value of investing in long-term capital investment projects.

Capital budgeting methods rely on measures of cash flows into and out of the firm; capital projects generate those cash flows. The investment cost for information systems projects is an immediate cash outflow caused by expenditures for hardware, software, and labor. In subsequent years, the investment may cause additional cash outflows that will be balanced by cash inflows resulting from the investment. Cash inflows take the form of increased sales of more products (for reasons such as new products, higher quality, or increasing market share) or reduced costs in production and operations. The difference between cash outflows and cash inflows is used for calculating the financial worth of an investment. Once the cash flows have been established, several alternative methods are available for comparing different projects and deciding about the investment.

The principal capital budgeting models for evaluating IT projects are the payback method, the accounting rate of return on investment (ROI), net present value, and the internal rate of return (IRR). You can find out more about how these capital budgeting models are used to justify information system investments in the Learning Tracks for this chapter.

3. Limitations of Financial Models

The traditional focus on the financial and technical aspects of an information system tends to overlook the social and organizational dimensions of information systems that may affect the true costs and benefits of the investment. Many companies’ information systems investment decisions do not adequately consider costs from organizational disruptions created by a new system, such as the cost to train end users, the impact that users’ learning curves for a new system have on productivity, or the time managers need to spend overseeing new system-related changes. Intangible benefits such as more timely decisions from a new system or enhanced employee learning and expertise may also be overlooked in a traditional financial analysis.

Source: Laudon Kenneth C., Laudon Jane Price (2020), Management Information Systems: Managing the Digital Firm, Pearson; 16th edition.

That is the precise weblog for anybody who wants to seek out out about this topic. You understand a lot its almost hard to argue with you (not that I truly would need…HaHa). You definitely put a new spin on a subject thats been written about for years. Great stuff, just nice!