There can be many ways to hedge a risk exposure. Some hedges are zero maintenance: Once established, the financial manager can walk away and worry about other matters. Other hedges are dynamic: They work only if adjusted at frequent intervals.

The forward contract between Northern Refineries and Arctic Fuels, which we described in Section 26-4, was zero maintenance because each counterparty locked in the price of heating oil at $2.40 per gallon, regardless of the future path of heating-oil prices. Now we look at an example where the financial manager will probably implement a dynamic hedge.

1. Hedging Interest Rate Risk

Potterton Leasing has acquired a warehouse and leased it to a manufacturer for fixed payments of $2 million per year for 20 years. The lease cannot be canceled by the manufacturer, so Potterton has a safe, debt-equivalent asset. The interest rate is 10%, and we ignore taxes for simplicity. The PV of Potterton’s rental income is $17 million:

![]()

The lease exposes Potterton to interest rate risk. If interest rates increase, the PV of the lease payments falls. If interest rates decrease, the PV rises. Potterton’s CFO therefore decides to issue an offsetting debt liability:

Thus, Potterton is long $17 million and also short $17 million. But it may not be hedged. Simply borrowing $17 million at some arbitrary maturity does not eliminate interest rate risk. Suppose the CFO took out a one-year, $17 million bank loan, with a plan to refinance the loan annually. Then she would be borrowing short and lending long (via the 20-year lease), which amounts to a $17 million bet that interest rates will fall. If instead they rise, her company will end up paying more interest in years 2 to 20, with no compensating increase in the lease cash flows.

To hedge interest rate risk, the CFO needs to design the debt issue so that any change in interest rates has the same (and thus offsetting) impact on both the PV of the lease payments and the PV of the debt. There are two ways to accomplish this:

- Zero-maintenance hedge.Issue debt requiring interest and principal payments of exactly $2 million per year for 20 years. This debt would be similar to a real estate mortgage with level payments. In this case, lease payments would exactly cover debt service in each year. The PVs of the lease payments and the offsetting debt would always be identical, regardless of the level of future interest rates.

- Duration hedge. Issue debt with the same duration as the lease payments. Here, debt service does not have to match the lease payments in each (or any) year. If durations are matched, then small changes in interest rates—say, from 10% down to 9.5% or up to 10.5%—will have the same impact on the PVs of the lease payments and the debt.

The duration-matching strategy is usually more convenient, but it is not zero maintenance because durations will drift out of line as interest rates change and time passes. Thus, the CFO will have to revisit and reset the hedge. She will have to execute a dynamic strategy to make duration matching work.

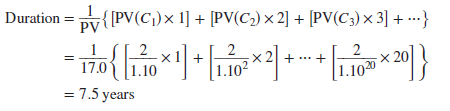

Potterton’s CFO first calculates the duration of the lease payments:[1]

Therefore, to hedge its interest rate risk, Potterton needs to issue a package of bonds with a duration of 7.5 years. The simplest solution is to issue a 12-year bond with a 10% coupon, which has a 7.5-year duration. But this is not the only possible strategy. For example, the company could issue $7.9 million of 10% 20-year bonds and $9.1 million of 10% 8-year bonds. The duration of this package would also be 7.5 years.[2]

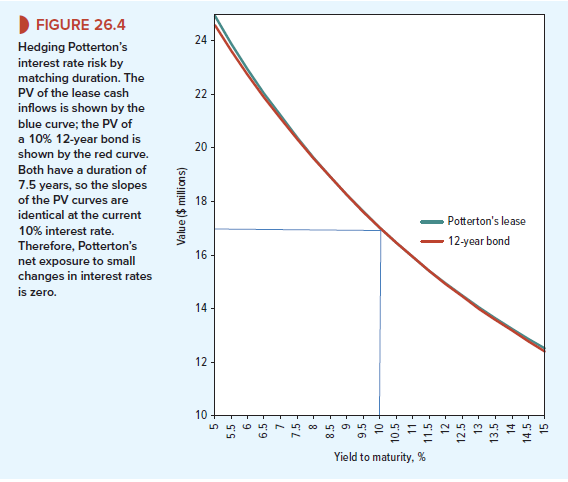

Figure 26.4 plots the PVs of the lease payments and the 12-year bond as a function of the interest rate. Both the PV curves are downward-sloping but convex; note how each curve comes down steeply at low interest rates but flattens out at higher interest rates.

Now compare the slope of the PV curve for the lease payments with the slope of the 12-year bond. The slopes are identical at the current 10% interest rate because the duration is identical at this rate. Therefore, so long as the interest rate does not stray too far from the current level of 10%, the PV of the lease cash flows change by almost the same amount as the PV of the bond. In this case, Potterton is hedged. But you can see from Figure 26.4 that if interest rates change by, say, 5%, the value of the lease payments changes by a little bit more than the value of the bond. In this case, Potterton’s CFO will have to reset the hedge.

She will also need to reset the hedge at some point even if interest rates do not change because the duration of the 12-year bond will decrease faster than that of the 20-year lease. For example, think forward 12 years: The bond will mature, while the lease will still have 8 years to run.

Duration is not a complete measure of interest rate risk. It measures only exposure to the level of interest rates, not to changes in the shape of the term structure. Duration in effect assumes that the term structure is “flat.” It is widely used, however, because it is a good first approximation to interest rate risk exposure. The mini-case at the end of this chapter offers another opportunity to use this concept.

2. Hedge Ratios and Basis Risk

In our example of Potterton Leasing, the CFO matched lease cash flows worth $17 million against debt worth $17 million. In other words, the hedge ratio for Potterton was exactly 1.

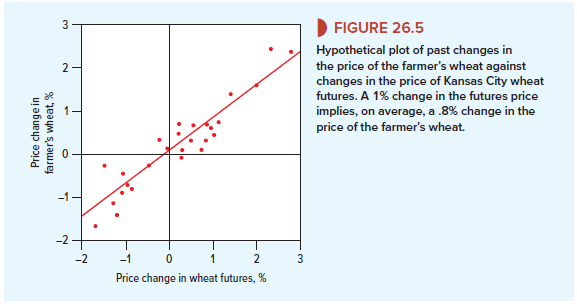

Hedge ratios can be much higher or lower than 1. For example, suppose a farmer owns 100,000 bushels of wheat and wishes to hedge by selling wheat futures. In practice, the wheat that the farmer owns and the wheat that he sells in the futures markets are unlikely to be identical. If he sells wheat futures on the Kansas City exchange, he agrees to deliver hard, red winter wheat in Kansas City in September. But perhaps he is growing northern spring wheat many miles from Kansas City; in this case, the prices of the two wheats will not move exactly together.

Figure 26.5 shows how changes in the prices of the two types of wheat may have been related in the past. The slope of the fitted line shows that a 1% change in the price of Kansas wheat was, on average, associated with an .8% change in the price of the farmer’s wheat. Because the price of the farmer’s wheat is relatively insensitive to changes in Kansas prices, he needs to sell .8 X 100,000 bushels of wheat futures to minimize risk.

Let us generalize. Suppose that you already own an asset, A (e.g., wheat), and you wish to hedge against changes in the value of A by making an offsetting sale of another asset, B (e.g., wheat futures). Suppose also that percentage changes in the value of A are related in the following way to percentage changes in the value of B:

Expected change in value of A = a + S(change in value of B)

Delta (S) measures the sensitivity of A to changes in the value of B. It is also equal to the hedge ratio—that is, the number of units of B that should be sold to hedge the purchase of A. You minimize risk if you offset your position in A by the sale of delta units of B.

The trick in setting up a hedge is to estimate the delta or hedge ratio. Our farmer could use past experience to do so, but often a strong dose of judgment is called for. For example, suppose that Antarctic Air would like to protect itself against a hike in oil prices. As the financial manager, you need to decide how much a rise in oil price would affect firm value.

Suppose the company spent $200 million on fuel last year. Other things equal, a 10% increase in the price of oil will cost the company an extra .1 X 200 = $20 million. But perhaps you can partially offset the higher costs by charging higher ticket prices, in which case earnings will fall by less than $20 million. Or perhaps an oil price rise will lead to a slowdown in business activity and therefore lower passenger numbers. In that case earnings will decline by more than $20 million. Working out the likely effect on firm value is even trickier because it depends on whether the rise is likely to be permanent. Perhaps the price rise will induce an increase in production or encourage consumers to economize on energy usage.

Whenever the two sides of the hedge do not move exactly together, there will be some basis risk. That is not a problem for the CFO of Potterton. As long as interest rates do not change sharply, any changes in the value of Potterton’s lease should be almost exactly offset by changes in the value of the debt. In this case there is no basis risk, and Potterton is perfectly hedged.

Our wheat farmer is less fortunate. The scatter of points in Figure 26.5 shows that it is not possible for the farmer to construct a perfect hedge using wheat futures. Since the underlying commodity (the farmer’s wheat) and the hedging instrument (Kansas City wheat futures) are imperfectly correlated, some basis risk remains.

Outstanding post, you have pointed out some fantastic points, I also think this s a very great website.