An American company that imports goods from France may need to buy euros to pay for the purchase. An American company exporting to France may receive euros, which it sells in exchange for dollars. Both firms make use of the foreign exchange market.

The foreign exchange market has no central marketplace. Business is conducted electronically. The principal dealers are the larger commercial banks and investment banks. A corporation that wants to buy or sell currency usually does so through a commercial bank. Turnover in the foreign exchange market is huge. In London in April 2016, $2,406 billion of currency changed hands each day. That is equivalent to an annual turnover of about $878 trillion ($878,000,000,000,000). New York, Singapore, Hong Kong, and Tokyo together accounted for a further $2,625 billion of turnover per day.[1]

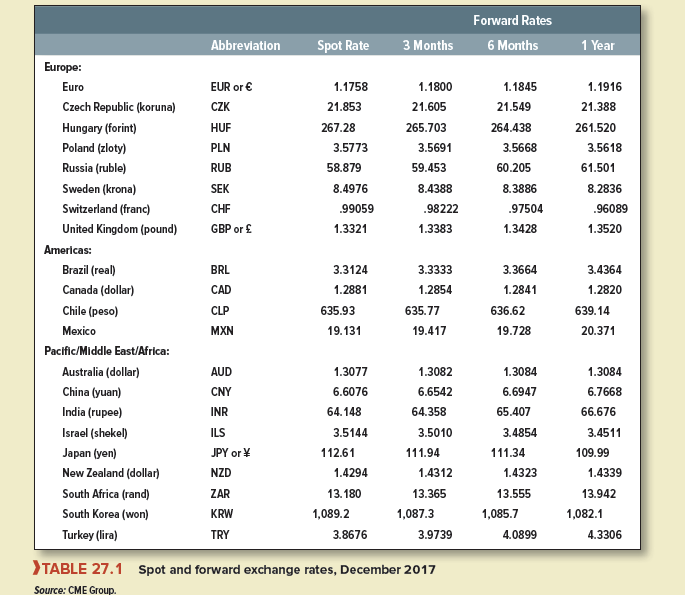

Table 27.1 shows a sample of exchange rates in December 2017. Exchange rates are generally expressed in terms of the number of units of the foreign currency needed to buy one U.S.dollar (USD). This is termed an indirect quote. In the first column of Table 27.1, the indirect quote for the Brazilian real shows that you could buy 3.3124 reals for $1. This is often written

as BRL3.3124/USD1.

A direct exchange rate quote states how many dollars you can buy for one unit of foreign currency. The euro and the British pound sterling are usually shown as direct quotes.2 For example, Table 27.1 shows that GBP1 is equivalent to USD1.3321 or, more concisely, USD1.3321/GBP1. If £1 buys $1.3321, then $1 must buy 1/1.3321 = GBP.7507. Thus, the indirect quote for the pound is GBP.7507/USD1.[2]

The exchange rates in the second column of Table 27.1 are the prices of currency for immediate delivery. These are known as spot rates of exchange. The spot rate for the real is BRL3.3124/USD1, and the spot rate for the pound is USD1.3321/GBP1.

In addition to the spot exchange market, there is a forward market. In the forward market you buy and sell currency for future delivery. If you know that you are going to pay out or receive foreign currency at some future date, you can insure yourself against loss by buying or selling forward. Thus, if you need one million reals in three months, you can enter into a three-month forward contract. The forward exchange rate on this contract is the price you agree to pay in three months when the one million reals are delivered. If you look again at Table 27.1, you will see that the three-month forward rate for the real is quoted at BRL3.3333/USD1. If you buy reals for three months’ delivery, you get more reals for your dollar than if you buy them spot. In this case, the real is said to trade at a forward discount relative to the dollar because forward reals are cheaper than spot ones. Expressed as an annual rate, the forward discount is

![]()

You could also say that the dollar was selling at a forward premium.

A forward purchase or sale is a made-to-measure transaction between you and the bank. It can be for any currency, any amount, and any delivery day. You could buy, say, 99,999 Vietnamese dong or Haitian gourdes for a year and a day forward as long as you can find a bank ready to deal. Most forward transactions are for six months or less, but the long-term currency swaps that we described in Chapter 26 are equivalent to a bundle of forward transactions. When firms want to enter into long-term forward contracts, they usually do so through a currency swap.

There is also an organized market for currency for future delivery known as the currency futures market. Futures contracts are highly standardized; they are for specified amounts and for a limited choice of delivery dates.

When you buy a forward or futures contract, you are committed to taking delivery of the currency. As an alternative, you can take out an option to buy or sell currency in the future at a price that is fixed today. Made-to-measure currency options can be bought from the major banks, and standardized options are traded on the options exchanges.

Excellent post. I was checking constantly this blog and I’m inspired! Very useful info specially the closing section 🙂 I care for such information much. I used to be seeking this particular information for a very lengthy time. Thank you and best of luck.