As illustrated in the prior section, when identical units of an item are purchased at different unit costs, an inventory cost flow method must be used. This is true regardless of whether the perpetual or periodic inventory system is used.

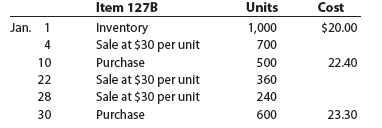

In this section, the FIFO, LIFO, and weighted average cost methods are illustrated under a perpetual inventory system. For purposes of illustration, the data for Item

1. First-In, First-Out Method

When the FIFO method is used, costs are included in the cost of merchandise sold in the order in which they were purchased. This is often the same as the physical flow of the merchandise. Thus, the FIFO method often provides results that are about the same as those that would have been obtained using the specific identification method. For example, grocery stores shelve milk and other perishable products by expiration dates. Products with early expiration dates are stocked in front. In this way, the oldest products (earliest purchases) are sold first.

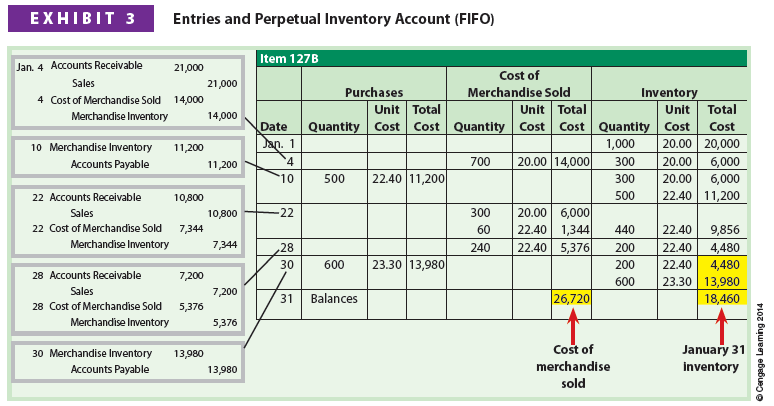

To illustrate, Exhibit 3 shows the use of FIFO under a perpetual inventory system for Item 127B. The journal entries and the subsidiary inventory ledger for Item 127B are shown in Exhibit 3 as follows:

- The beginning balance on January 1 is $20,000 (1,000 units at a unit cost of $20).

- On January 4, 700 units were sold at a price of $30 each for sales of $21,000 (700 units x $30). The cost of merchandise sold is $14,000 (700 units at a unit cost of $20). After the sale, there remains $6,000 of inventory (300 units at a unit cost of $20).

- On January 10, $11,200 is purchased (500 units at a unit cost of $22.40). After the purchase, the inventory is reported on two lines, $6,000 (300 units at a unit cost of $20.00) from the beginning inventory and $11,200 (500 units at a unit cost of $22.40) from the January 10 purchase.

- On January 22, 360 units are sold at a price of $30 each for sales of $10,800 (360 units x $30). Using FIFO, the cost of merchandise sold of $7,344 consists of $6,000 (300 units at a unit cost of $20.00) from the beginning inventory plus $1,344 (60 units at a unit cost of $22.40) from the January 10 purchase. After the sale, there remains $9,856 of inventory (440 units at a unit cost of $22.40) from the January 10 purchase.

- The January 28 sale and January 30 purchase are recorded in a similar manner.

- The ending balance on January 31 is $18,460. This balance is made up of two layers of inventory as follows:

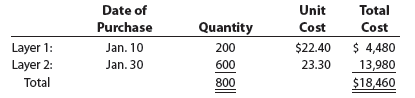

2. Last-In, First-Out Method

When the LIFO method is used, the cost of the units sold is the cost of the most recent purchases. The LIFO method was originally used in those rare cases where the units sold were taken from the most recently purchased units. However, for tax purposes, LIFO is now widely used even when it does not represent the physical flow of units. The tax impact of LIFO is discussed later in this chapter.

To illustrate, Exhibit 4 shows the use of LIFO under a perpetual inventory system for Item 127B. The journal entries and the subsidiary inventory ledger for Item 127B are shown in Exhibit 4 as follows:

- The beginning balance on January 1 is $20,000 (1,000 units at a unit of cost of $20.00).

- On January 4, 700 units were sold at a price of $30 each for sales of $21,000 (700 units x $30). The cost of merchandise sold is $14,000 (700 units at a unit cost of $20). After the sale, there remains $6,000 of inventory (300 units at a unit cost of $20).

- On January 10, $11,200 is purchased (500 units at a unit cost of $22.40). After the purchase, the inventory is reported on two lines, $6,000 (300 units at a unit cost of $20.00) from the beginning inventory and $11,200 (500 units at $22.40 per unit) from the January 10 purchase.

- On January 22, 360 units are sold at a price of $30 each for sales of $10,800 (360 units x $30). Using LIFO, the cost of merchandise sold is $8,064 (360 units at unit cost of $22.40) from the January 10 purchase. After the sale, there remains $9,136 of inventory consisting of $6,000 (300 units at a unit cost of $20.00) from the beginning inventory and $3,136 (140 units at a unit cost of $22.40) from the January 10 purchase.

- The January 28 sale and January 30 purchase are recorded in a similar manner.

- The ending balance on January 31 is $17,980. This balance is made up of two layers of inventory as follows:

When the LIFO method is used, the subsidiary inventory ledger is sometimes maintained in units only. The units are converted to dollars when the financial statements are prepared at the end of the period.

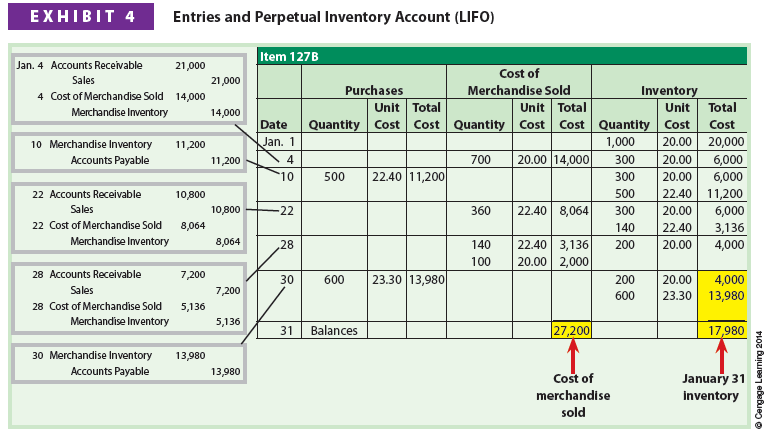

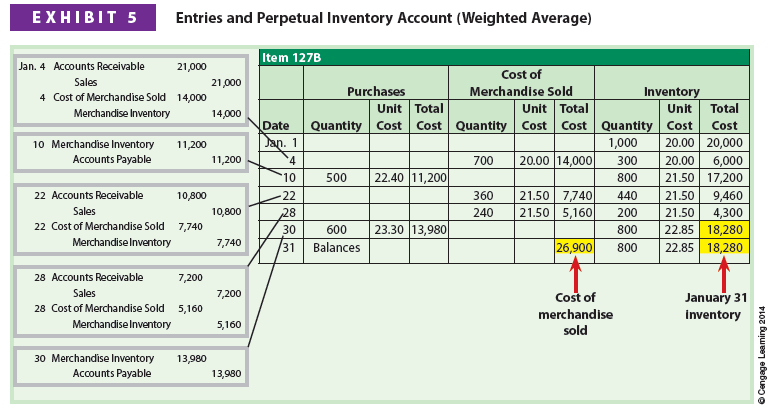

3. Weighted Average Cost Method

When the weighted average cost method is used in a perpetual inventory system, a weighted average unit cost for each item is computed each time a purchase is made. This unit cost is used to determine the cost of each sale until another purchase is made and a new average is computed. This technique is called a moving average.

To illustrate, Exhibit 5 shows the use of weighted average under a perpetual inventory system for Item 127B.

The journal entries and the subsidiary inventory ledger for Item 127B are shown in Exhibit 5 as follows:

- The beginning balance on January 1 is $20,000 (1,000 units at a unit cost of $20).

- On January 4, 700 units were sold at a price of $30 each for sales of $21,000 (700 units x $30). The cost of merchandise sold is $14,000 (700 units at a unit cost of $20.00). After the sale, there remains $6,000 of inventory (300 units at a unit cost of $20.00).

- On January 10, $11,200 is purchased (500 units at a unit cost of $22.40). After the purchase, the weighted average unit cost of $21.50 is determined by dividing the total cost of the inventory on hand of $17,200 ($6,000 + $11,200) by the total quantity of inventory on hand of 800 (300 + 500) units. Thus, after the purchase, the inventory consists of 800 units at $21.50 per unit for a total cost of $17,200.

- On January 22, 360 units are sold at a price of $30 each for sales of $10,800 (360 units x $30). Using weighted average, the cost of merchandise sold is $7,740 (360 units x $21.50 per unit). After the sale, there remains $9,460 of inventory (440 units x $21.50 per unit).

- The January 28 sale and January 30 purchase are recorded in a similar manner.

- The ending balance on January 31 is $18,280 (800 units x $22.85 per unit).

4. Computerized Perpetual Inventory Systems

A perpetual inventory system may be used in a manual accounting system. However, if there are many inventory transactions, such a system is costly and time consuming. In almost all cases, perpetual inventory systems are computerized.

Computerized perpetual inventory systems are useful to managers in controlling and managing inventory. For example, fast-selling items can be reordered before the stock runs out. Sales patterns can also be analyzed to determine when to mark down merchandise or when to restock seasonal merchandise. Finally, inventory data can be used in evaluating advertising campaigns and sales promotions.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

This is my first time visit at here and i am truly happy to read everthing at one place.

Terrific article! This is the type of info that should be shared around the internet.

Disgrace on Google for no longer positioning this publish upper!

Come on over and discuss with my web site . Thank you =)

Very shortly this site will be famous among all blog visitors, due to it’s fastidious posts

Hi there, after reading this amazing article i am as well delighted to share

my familiarity here with colleagues.

It is really a nice and helpful piece of info. I am glad that you shared this useful information with us. Please keep us informed like this. Thanks for sharing.